SideShift.ai Weekly Report | 8th - 14th November 2022

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the twenty-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the twenty-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

XAI Token Market Update

This week SideShift token (XAI) moved within the 7 day range of $0.1001 / $0.1327, slightly lower than the range noted last week. Considering current market conditions, XAI has been holding up quite well. At the time of writing the price of XAI is sitting at $0.1144, with the XAI circulating market cap measuring $10,761,739.

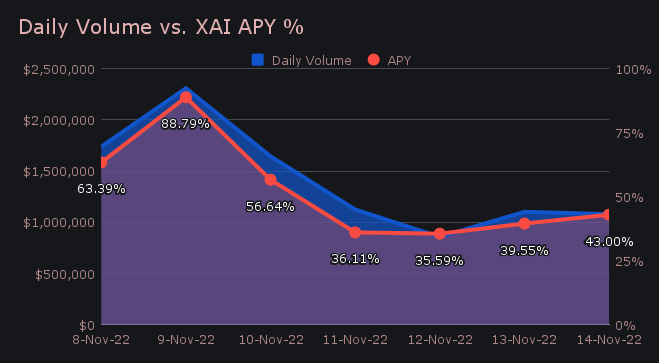

An incredibly volatile week led to strong daily volumes on SideShift, and resulted in an outstanding average APY of 51.87%. This is approximately 24% higher than our all time average, and is one of our highest weekly averages of 2022 so far. For stakers, a sum of 67,701.87 XAI was deposited to our staking vault on November 10th, 2022, following a net daily volume of $2.31m. This amounted to a superb daily APY of 88.79%.

If you have yet to do so but want to participate in XAI staking, remember that you can easily shift directly to svXAI from any coin of your choice. You can create a shift to svXAI here, and learn more about XAI staking in our FAQ.

Additional XAI updates:

Total Value Staked: 39,054,394 XAI

Total Value Locked: $4,487,481

General Business News:

What a week. As the adage goes, “it’s never a dull week in crypto land”. Be sure to check out the shitcoin.com newsletter for a full breakdown of last week’s black swan event, and to stay updated with the latest crypto market news.

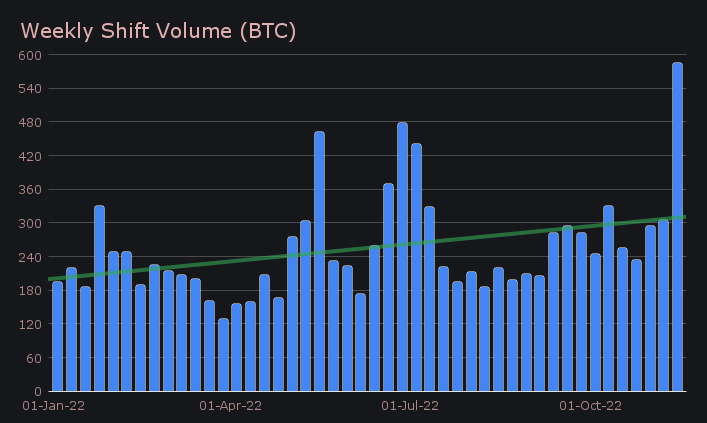

As prefaced in the previous report, volatility in any direction typically results in a strong showing for SideShift.ai. Despite the immense downwards pressure and overall negative market sentiment, SideShift had its best week in nearly 5 months. We rounded out the period with a net volume of $9.86m alongside 7,186 shifts. Although shift count was majorly on par with what was noted last week (-1.6%), weekly volume boomed and increased by 55.5%. These figures combined to produce daily averages of $1.41m on 1,024 shifts. In BTC terms the volume increase was even more dramatic, jumping by 91.5% to total 584.22 BTC for the week.

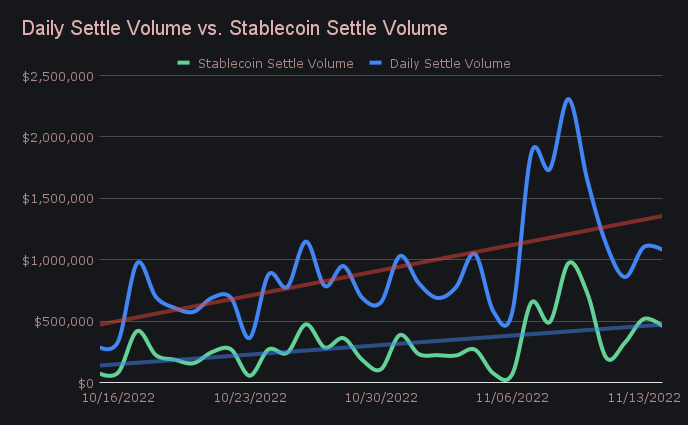

BTC was the clear coin of choice for users, with total volume (deposits + settlements) rising 63.6% and summing to $5.42m. In other words, ~55% of shifts this week contained BTC. It was the week’s most deposited coin with $2.23m in deposits (+39.2%). This was followed by ETH, which saw its deposits grow by 107% to net $1.79m. Coins 3-5 were all stablecoins - USDT on Ethereum ($1.33m), USDC on Ethereum ($1.04m), and USDT on Tron ($705k). The influx of stablecoins this week was notable, with USDT on Ethereum deposits more than tripling, and USDT on Tron approximately doubling.

Still, it’s interesting to point out that although the pair of BTC / USDT (ERC-20) prevailed as most popular with a net volume of $981k, it only hung onto this title by a thread. USDT (ERC-20) / BTC was right behind, with a weekly total of $970k. What this tells us is that the volatility resulted in relatively equal amounts of panic selling, and buying the dip, furthering the notion of why volatility is good for SideShift.

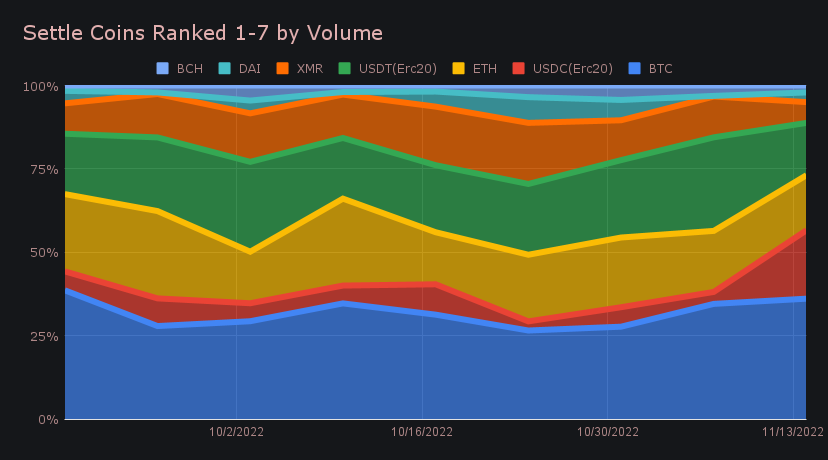

On the settle side, BTC dominated once again with a net settle volume of $3.19m (+86.5%) for the period. USDC on Ethereum roared into second place with more than a tenfold increase. It finished with $1.81m, $500k of which was shifted from USDT on Tron. ETH placed third with a very respectable $1.46m (+60.9%). You can visualize the sharp increase in USDC (ERC-20) settlements in the chart below.

Most coins saw a healthy increase in shift volume, but a handful rose in dramatic fashion. A steady stream of ZEC (shielded) deposits were shifted into a mixture of DAI and USDC (ERC-20) earlier in the week, resulting in total ZEC (shielded) volume growing by 660% ($421k). Another visible trend was funds flowing from the Solana network elsewhere - most notably USDC on Solana to USDC on Ethereum. Users were likely fleeing the Solana network due to sharp downwards price movement and circulating rumors - on SideShift this led to USDC on Solana’s total volume rising 812%, to net $285k.

It should be mentioned here that overall stablecoin settle volume accounted for a record 37.1% of the total this week, a substantial ~10% jump from proportions seen throughout the past few months.

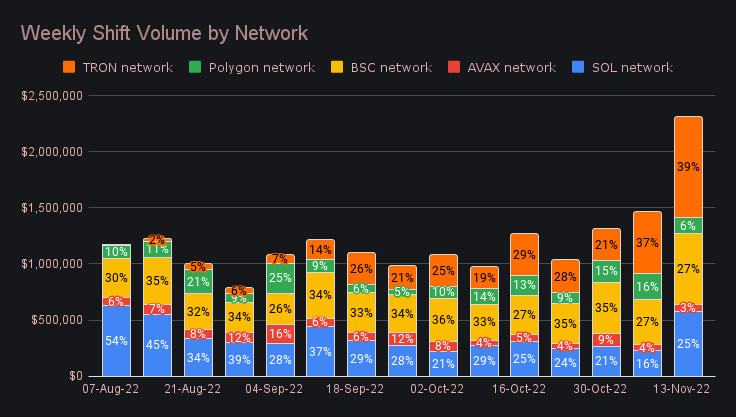

Networks other than Ethereum saw a significant rise of 58.2% and combined for a total volume of $2.31m. This is a solid increase, but still only about ⅓ of total volume when compared to the Ethereum network. Nevertheless, growth is evident and once again Tron shined in this category. For the second consecutive week, it was the most popular network among alternatives to Ethereum, with shifted coins on Tron totalling to a sum of $893k. This is almost entirely due to USDT (TRC-20) shifts. The BSC and SOL networks saw respective nominal increases of 58.4% and 154.7%, representing sizable growth. However, when looking at the proportion of total volume, they remain fairly similar to levels seen in recent weeks.

In general news, SideShift had a solid but busy week. All in all we encountered few issues, with most issues that did arise being a result of the FTX meltdown. The most notable was a backlog of shifts occurring on November 10th, due to rate instability and huge market volatility. Our engineers responded quickly to the rates issue and found alternate solutions - all stuck shifts were settled within a couple of hours. Finally, a handful of ERC-20 tokens were disabled - CRO, SWEAT, TUSD, LOOKS for various reasons. These remain disabled for the time being.

Integration News

Integrations closed the week with a combined $3.60m (36.5%) in volume, marking a 5.7% increase from the previous period. This was alongside a shift count of 2,804, which represented 39.1% of the total count. Now for the first time in nearly 2 months, the shift count proportion for integrations has dipped below 40%. With that being said, shift count remains continually high, firmly above seven thousand shifts per week.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.