SideShift.ai Weekly Report | 9th - 15th January 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the eighty-seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the eighty-seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) move within the 7 day price range of $0.1489 / $0.1635. This is not to be confused with what was briefly displayed on CoinGecko, which was an error and will be rectified soon. At the time of writing, XAI is sitting at a price of $0.1647, and has a current market cap of $21,478,911 (-11.6%).

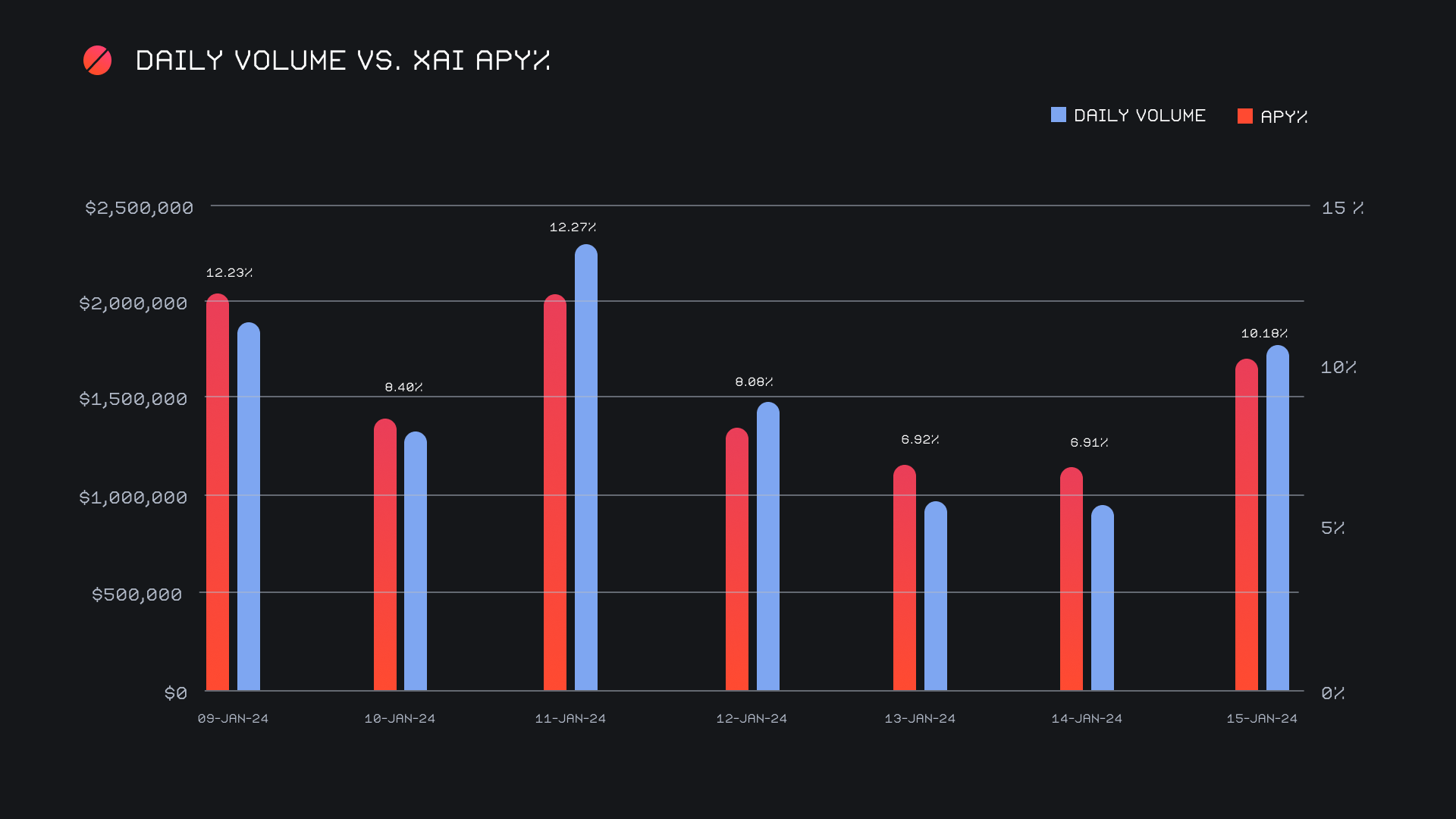

XAI stakers were rewarded with an average APY of 9.3% this week, with a daily rewards high of 36,590.65 XAI being distributed to our staking vault on January 12th, 2024. This was following a daily volume of $2.3m. This week XAI stakers received a total of 196,025.81 XAI, or $32,285.45 USD.

An additional 50 ETH was deposited to SideShift’s treasury on January 12th, 2024, bringing the current total to a value of $9.0m. Users are encouraged to follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 115,557,088 XAI (+0.2%)

Total Value Locked: $18,987,249 (-6.7%)

General Business News

This past week contained a watershed moment in BTC’s history with the approval of multiple spot ETFs. The hype was real and Bitcoin was on a mission, climbing as high as $49k leading up to this monumental announcement. Ultimately though, it ended up being more of a ‘sell the news’ event, as BTC tumbled as much as -15% to then find its footing at the current $43k level.

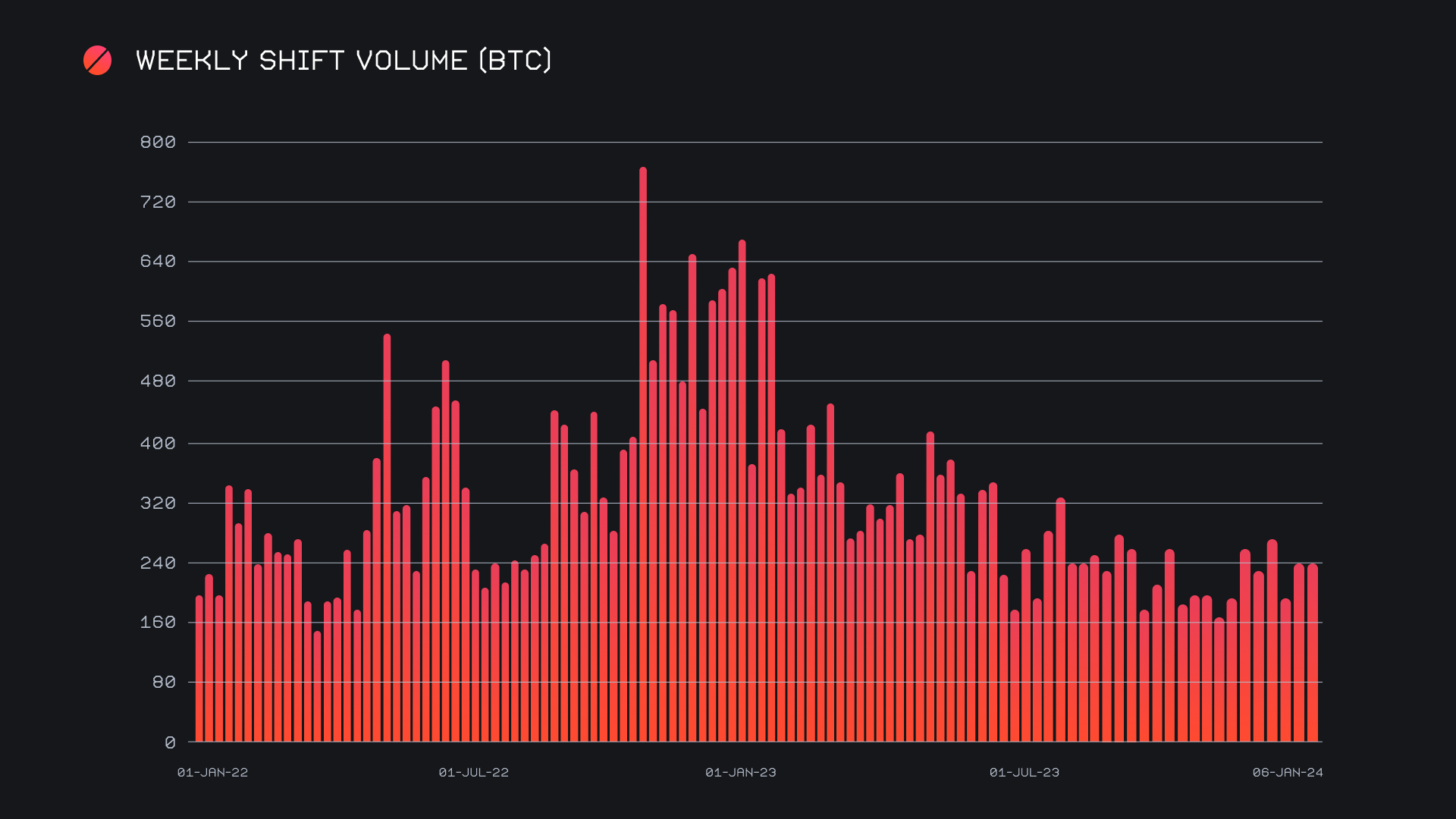

The momentum that was establishing itself within the broader market was evident on SideShift, as we had another solid week largely on par with the previous. We ended the period with a gross $10.7m (+0.8%) alongside a shift count of 8,176 (+0.7%), thereby continuing the weekly trend of $10m in volume on a shift count of 8,000 or greater. Since the beginning of December 2023 this has rang true for all but one week, Christmas. Together, these figures combined to produce daily averages of $1.5m on 1,168 shifts. When denoted in BTC, our weekly volume amounted to 240.93 BTC (+0.7%).

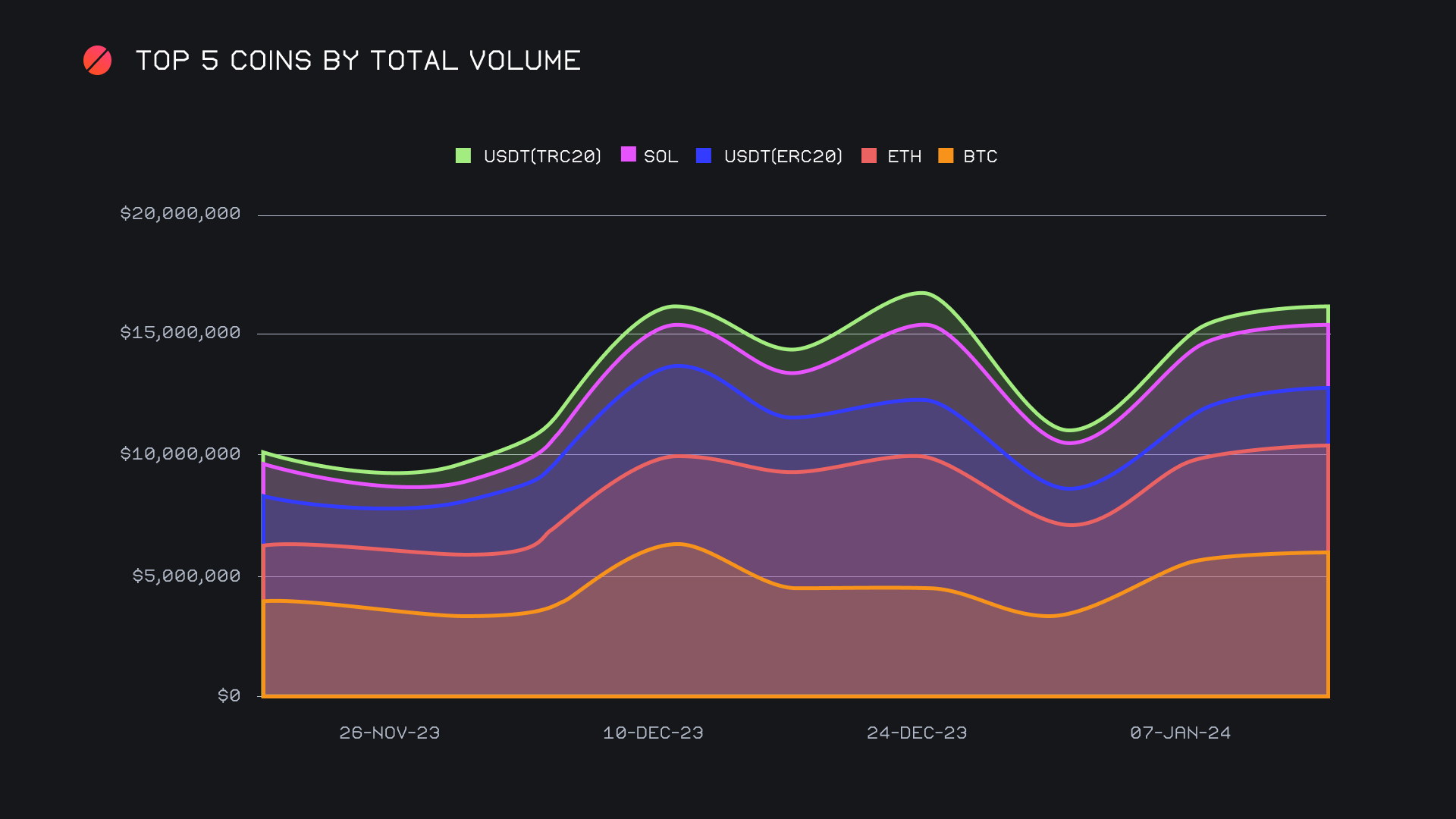

Our top 5 coins always combine to account for a vast majority of volume, but it is really our top 2 which represent the bulk. As seen in the below chart, BTC and ETH combined to sum nearly $10m in total volume (deposits + settlements) each week for most of December 2023, and then continued on with this into the new year. This aligns with the aforementioned trend in strength, and it is clear that these two coins are the driving forces. BTC claimed first place, rising +5.8% to sum an even $6.0m on the week. A fairly even split between user deposits and settlements comprised this sum, although there was a notable surge in BTC buying the day of the ETF announcement. This amounted to about $675k in user BTC settlements, which is more than 2x higher the daily average seen so far this month.

Sitting not too far behind was second placed ETH, which netted a total volume of $4.5m with a modest increase of +4%. For ETH, the edge was still given to settlements, as a net user settlement volume of $1.9m outpaced that of deposits by about $130k. Throughout the week ETH settlements remained consistently high, and were actually on track to rank first had it not been for the surge in BTC buying on January 11th, 2024. The BTC/ETH pair was a primary source of the ETH settlement volume, as it finished as the week's most popular pair once again, this time with ~$1.1m. Following ETH came SOL, along with a bundle of stablecoins. SOL ended up measuring the biggest decline among top coins, falling -20% for a $1.9m, fourth placed finish. This occurred following three consecutive weeks above $2m, and was primarily the cause of lesser SOL deposits. User SOL settlements actually rose by +7.5% for $872k, indicating users are still fairly bullish and insistent on stacking SOL.

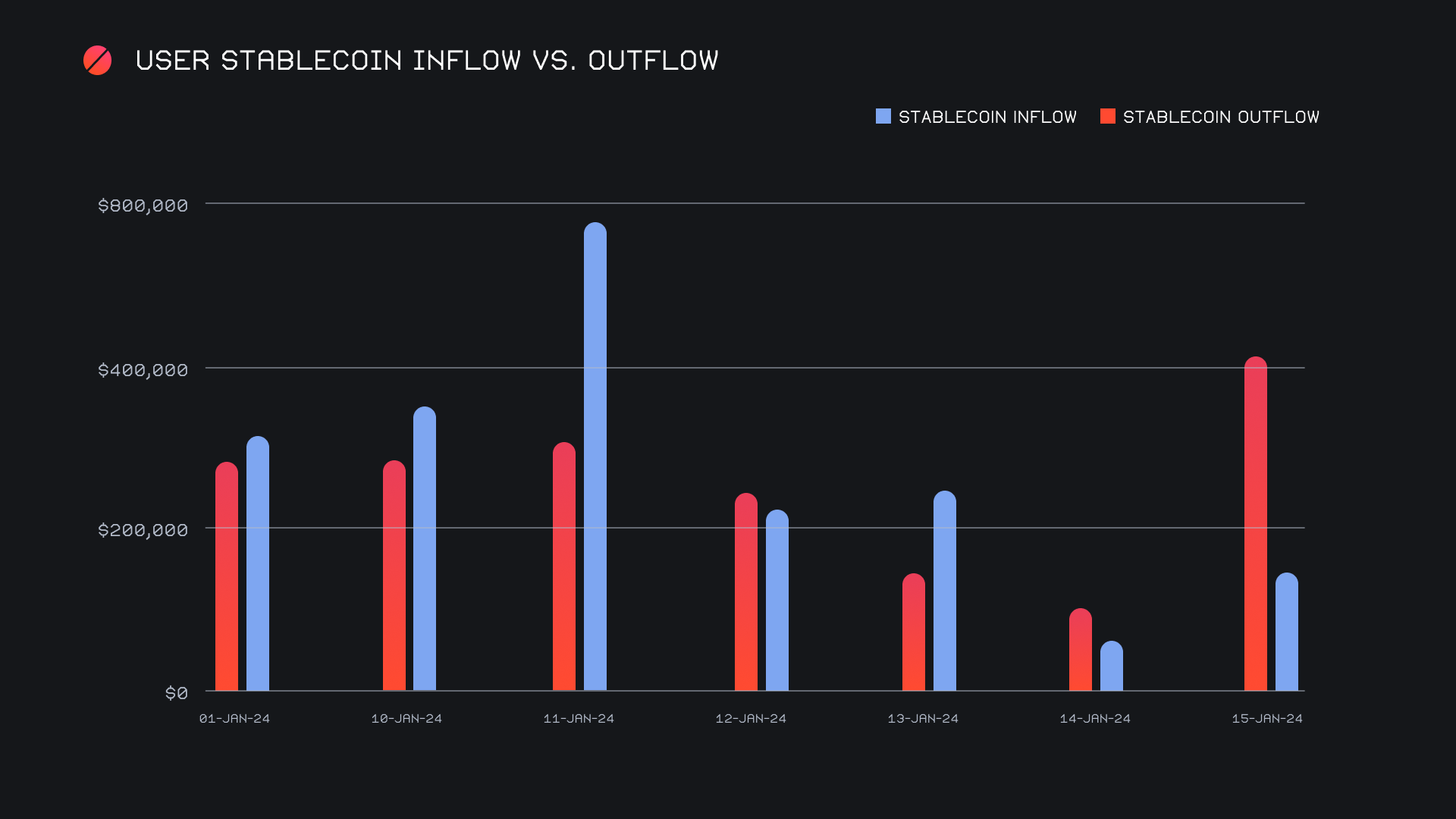

Behaving in the opposite way to SOL was the majority of stablecoins, which saw their total volumes increase, but mostly at the hands of increased user deposits. Our top stablecoin, USDT (ERC-20) embodied this the most, with user deposits booming +60% for approximately $900k. DAI (ERC-20) also displayed the same trend, with user deposits more than doubling, albeit with a lower deposit volume of $221k. This pattern also aligned with the ETF announcement, as a major influx of stablecoins was evident around January 11th, 2024, as shown in the below chart. This week also marked another milestone, as it was the first time that stablecoin inflows exceeded outflows since we began tracking this metric. Essentially, this means SideShift users are more bullish overall, and on average prefer being exposed to the market as opposed to remaining in the safety of stablecoins. The net stablecoin flow for this week was +$97k.

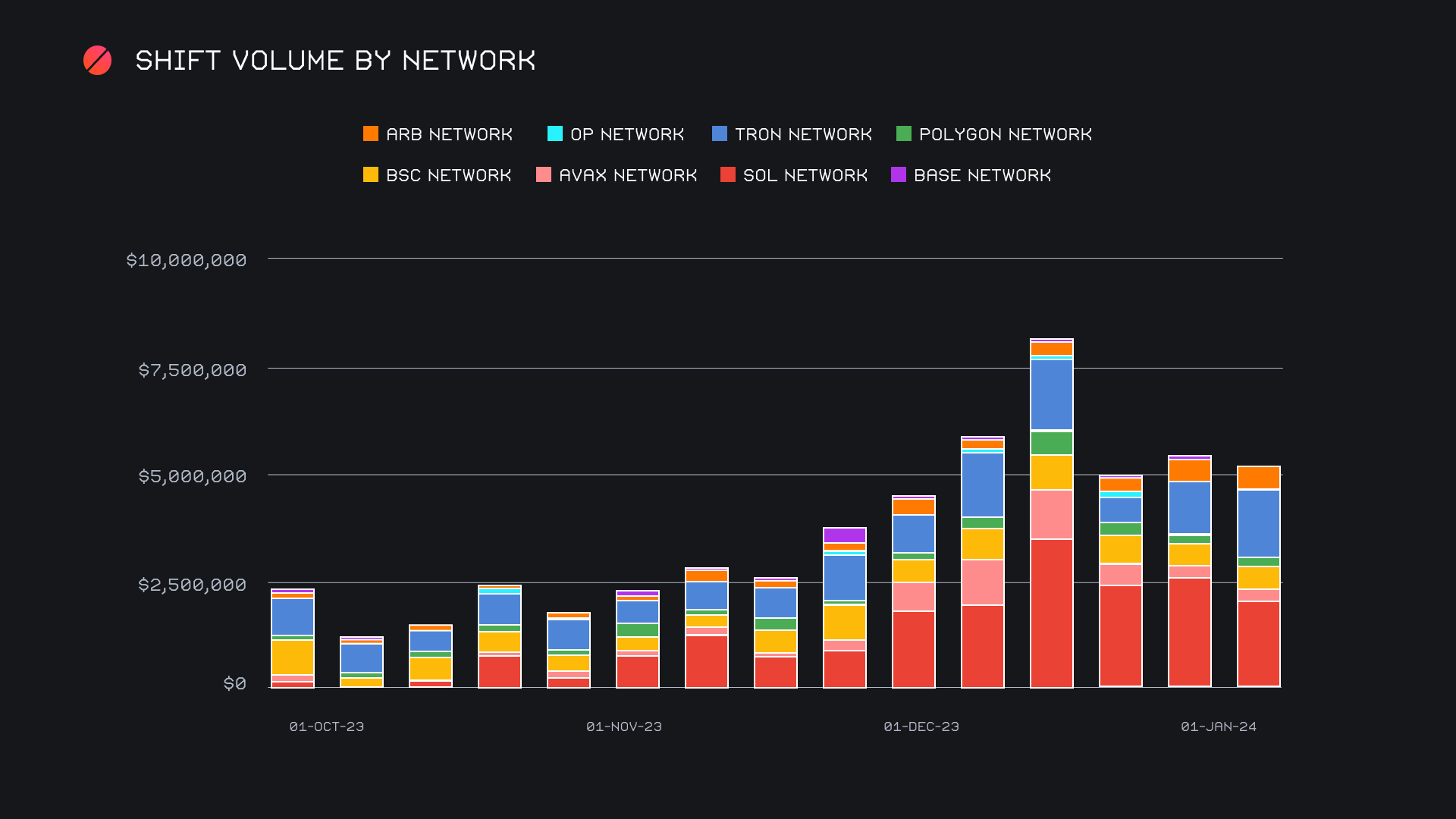

When looking at alternate networks to Ethereum, combined volume continued to maintain the $5m mark, although with a different composition. As previously mentioned, shifting on the Solana network has slowed slightly after a significant run up in recent weeks, although it still remained the leader of the pack with $2.1m (-19.6%). Increased activity for USDT (TRC-20) aided in the Tron network ascending +30.3% for a respectable $1.6m. Far behind the top networks came the Binance Smart Chain and Arbitrum networks, which had respective volumes of $485k and $475k. Both of these networks recorded a weekly volume decrease, as did every other alternate network with the exception of Optimism. Although the focus primarily remains on BTC and ETH, it's promising to see these alternate networks hold their ground and continue to generate a decent chunk of shift volume.

Affiliate News

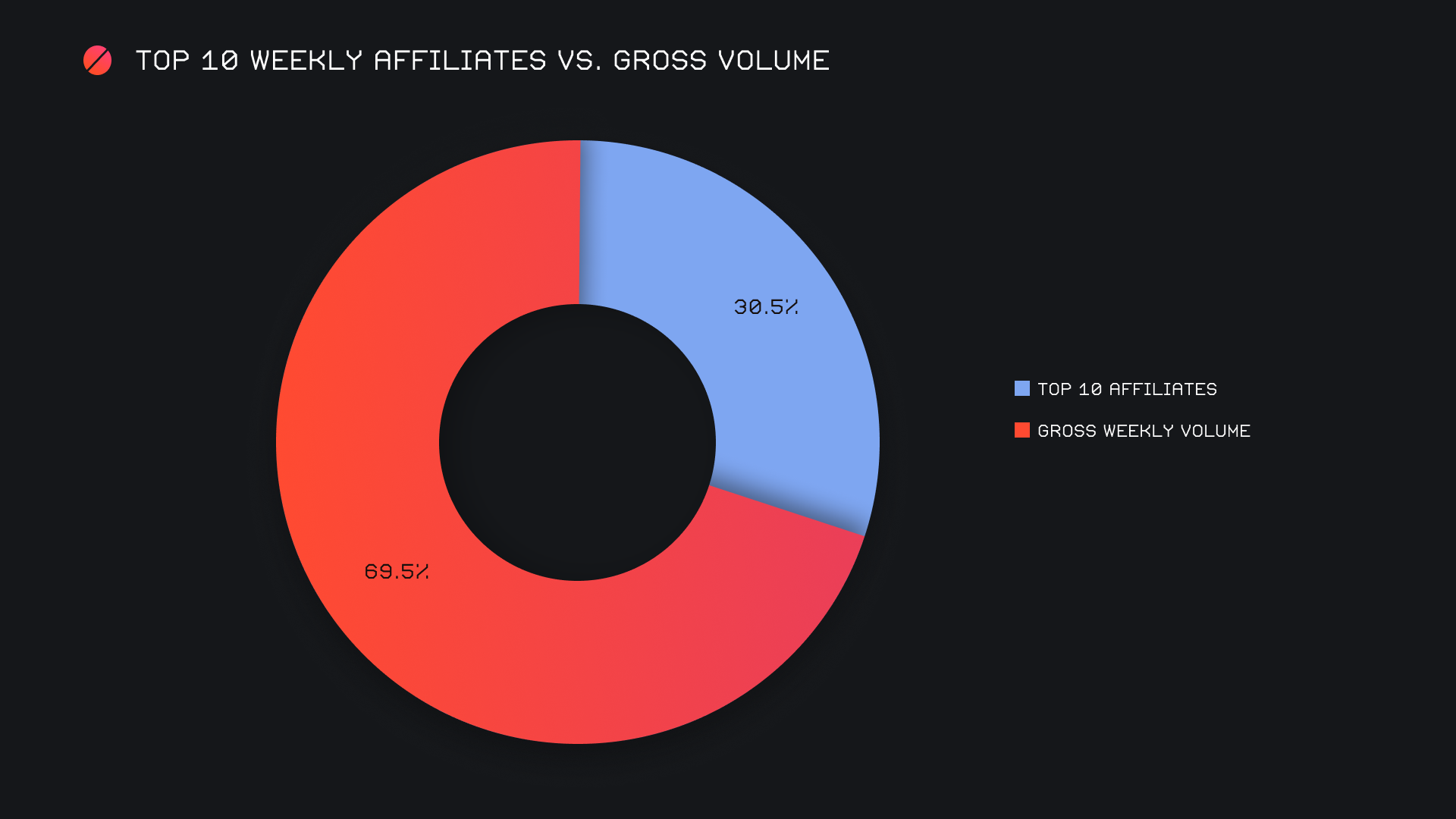

Our top affiliates combined for a total $3.3m (+22.9%) alongside a shift count of 2,213 (+26.5%), thanks to multiple $1m performances. Our first placed affiliate remained unchanged, and this week tallied $1.08m with an impressive shift count of 1,001. The dark horse however was the newly ranked runner up, which stormed into second place on the back of a monster +166% increase. It rounded off the week with a gross $1.06m, and finished among the top two affiliates for the first time.

All together, SideShift’s top affiliates came together to account for 30.5% of our weekly volume, approximately 5.5% higher than last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.