SideShift.ai Weekly Report | 9th - 15th July 2024

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one-hundred-and-thirteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and thirteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw the SideShift token (XAI) undergo a mostly sideways performance, with its 7-day price moving within the range of $0.1609 to $0.1683. At the time of writing, XAI is currently priced at $0.1646 with a market cap of $22,478,456, which is an approximate decrease of -1.76% from last week’s measure.

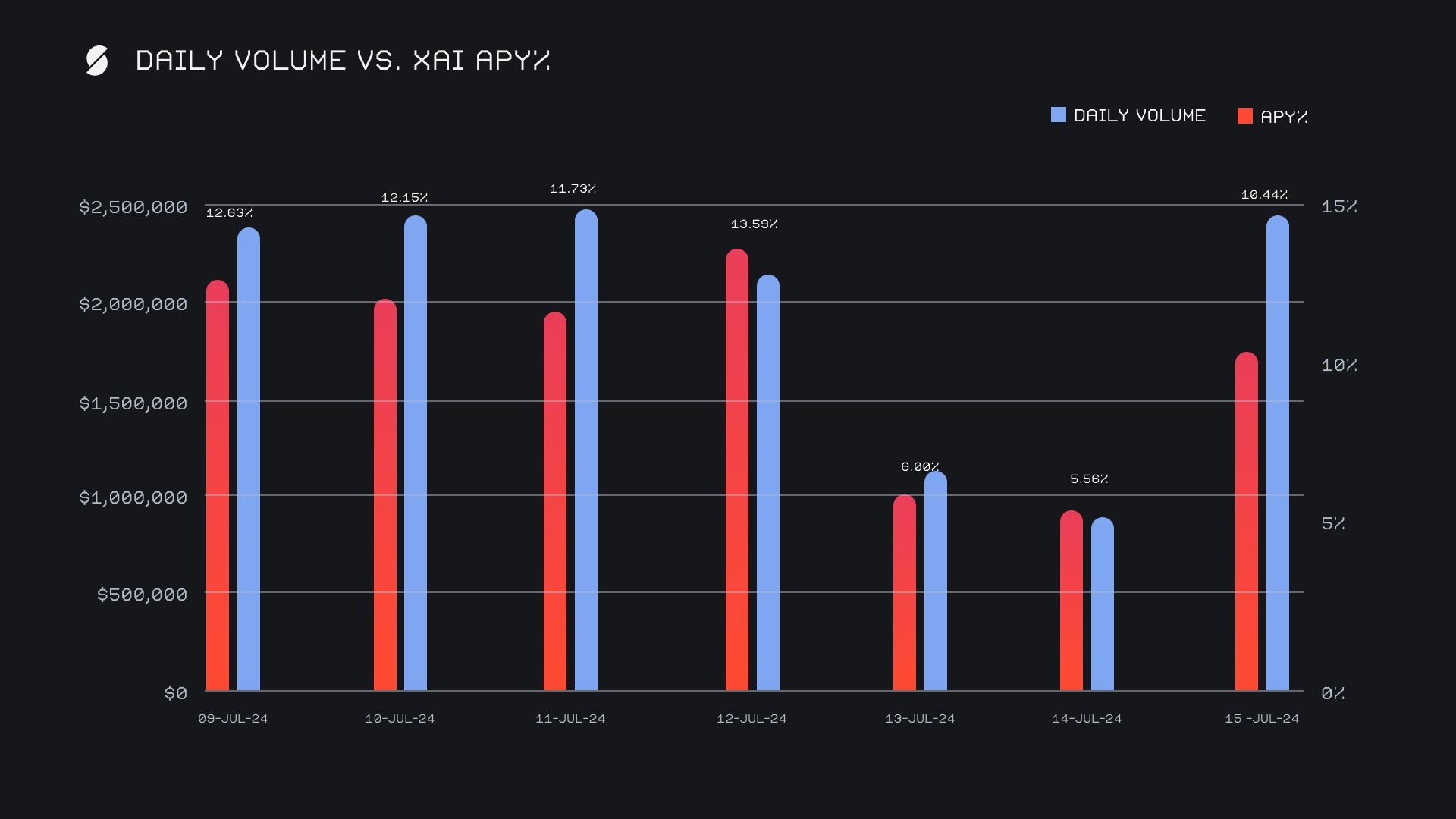

XAI stakers were rewarded with an average APY of 10.30% this week. The highest daily reward was distributed on July 12th, 2024, totaling 42,551.4 XAI with an APY of 13.59%. This reward followed a daily volume of $2.2m. In total, XAI stakers received 228,258.10 XAI or $37,571.28 USD in staking rewards this week.

The price of 1 svXAI is now equal to 1.3537 XAI, representing a 35.37% accrual on stakers investments. A friendly reminder that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 122,044,293 XAI (+0.2%)

Total Value Locked: $20,016,552 (-2%)

General Business News

This week, the SEC gave the green light for the launch of spot Ethereum ETFs, which are now set to begin trading on July 23. Bitcoin and other cryptocurrencies saw an encouraging boost following an attempted assassination on Donald Trump, who announced pro-crypto Senator J.D. Vance as his running mate.

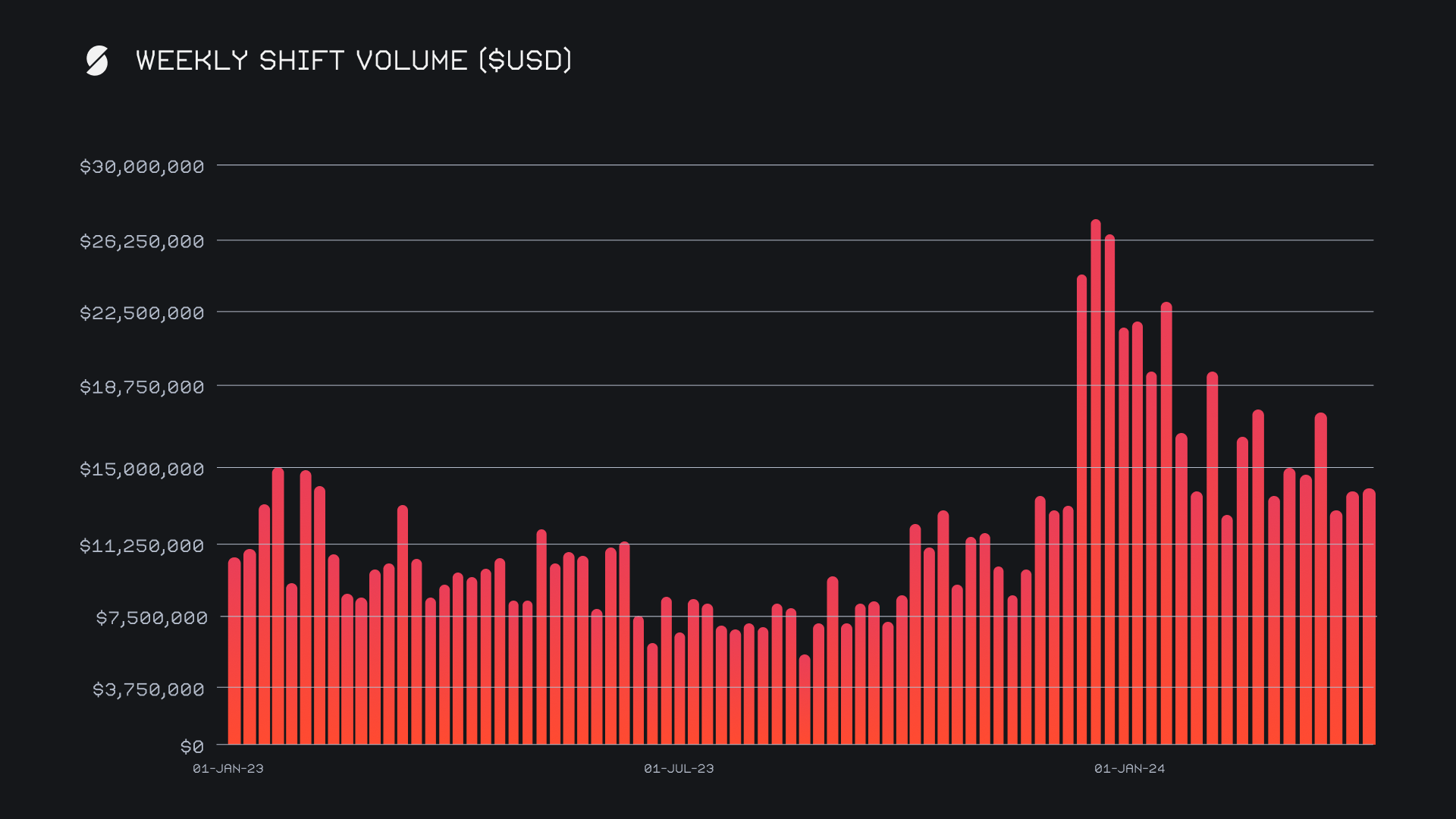

SideShift maintained its momentum with a slight increase in performance, closing the week with a gross volume of $13.9m (+1.0%). Although this week’s total is modest in comparison to peaks seen earlier this year, it still ended as our best week so far this month. Together with our weekly shift count, we ended with daily averages of $1.99m across 1,533 shifts, representing a fairly consistent demand. The BTC/ETH pair was the clear favorite among users this week, totaling $1.48m, followed closely by BTC/USDT (ERC-20) with $1.12m.

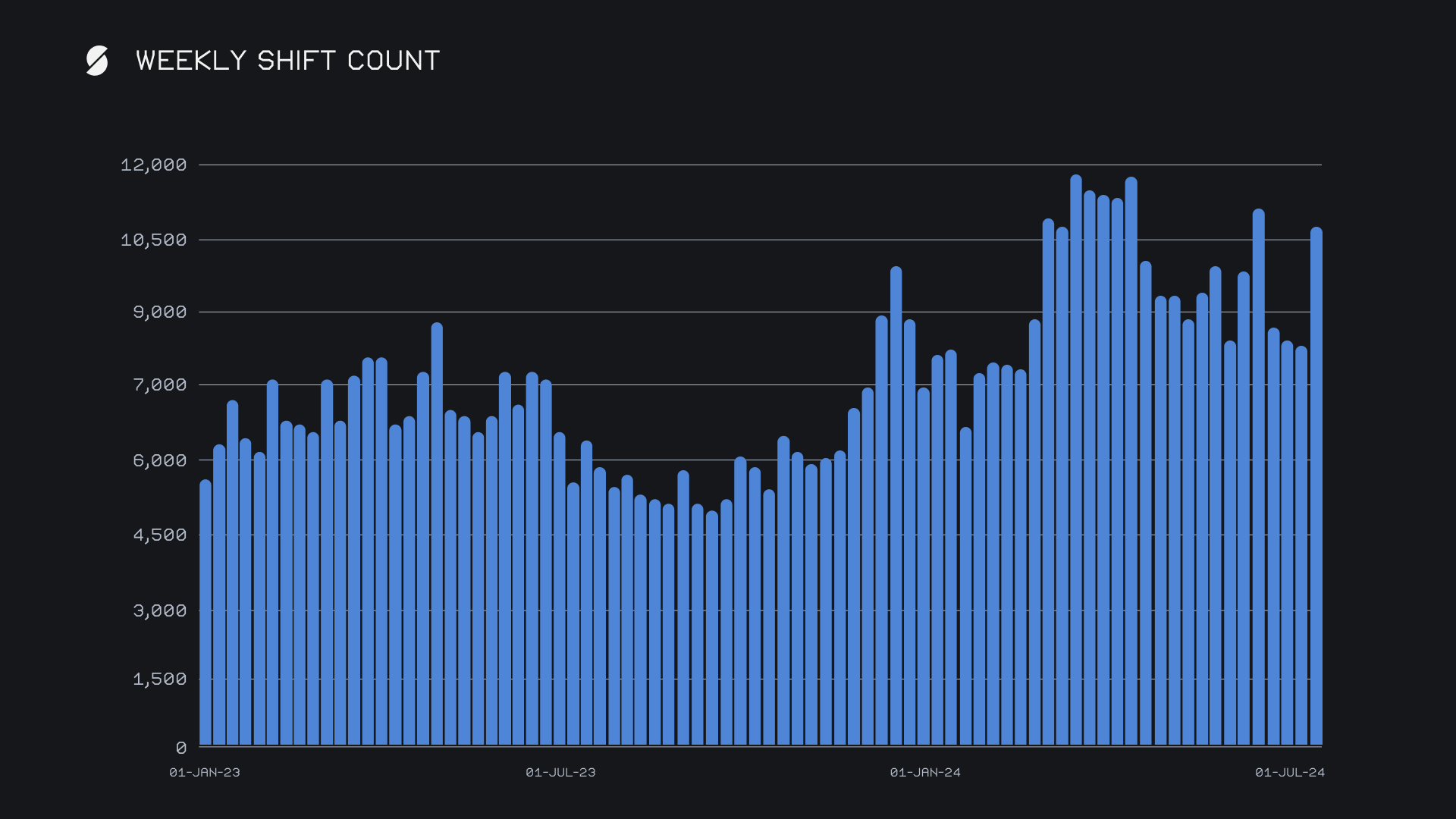

The weekly shift count showed a robust growth of 29.3%, reaching 10,734 shifts, marking a substantial rise from the previous week's 8,301 shifts. This uptick in shift activity signals an encouraging trend in user engagement on our platform. Further, this surge in user shift count swiftly approached our highest levels to date, and ranked as our 7th highest week of all time, about 1,000 shifts short of the weekly record. This move also coincided with a recent reduction of our shift minimum to $5, which may have played a factor in the overall increase.

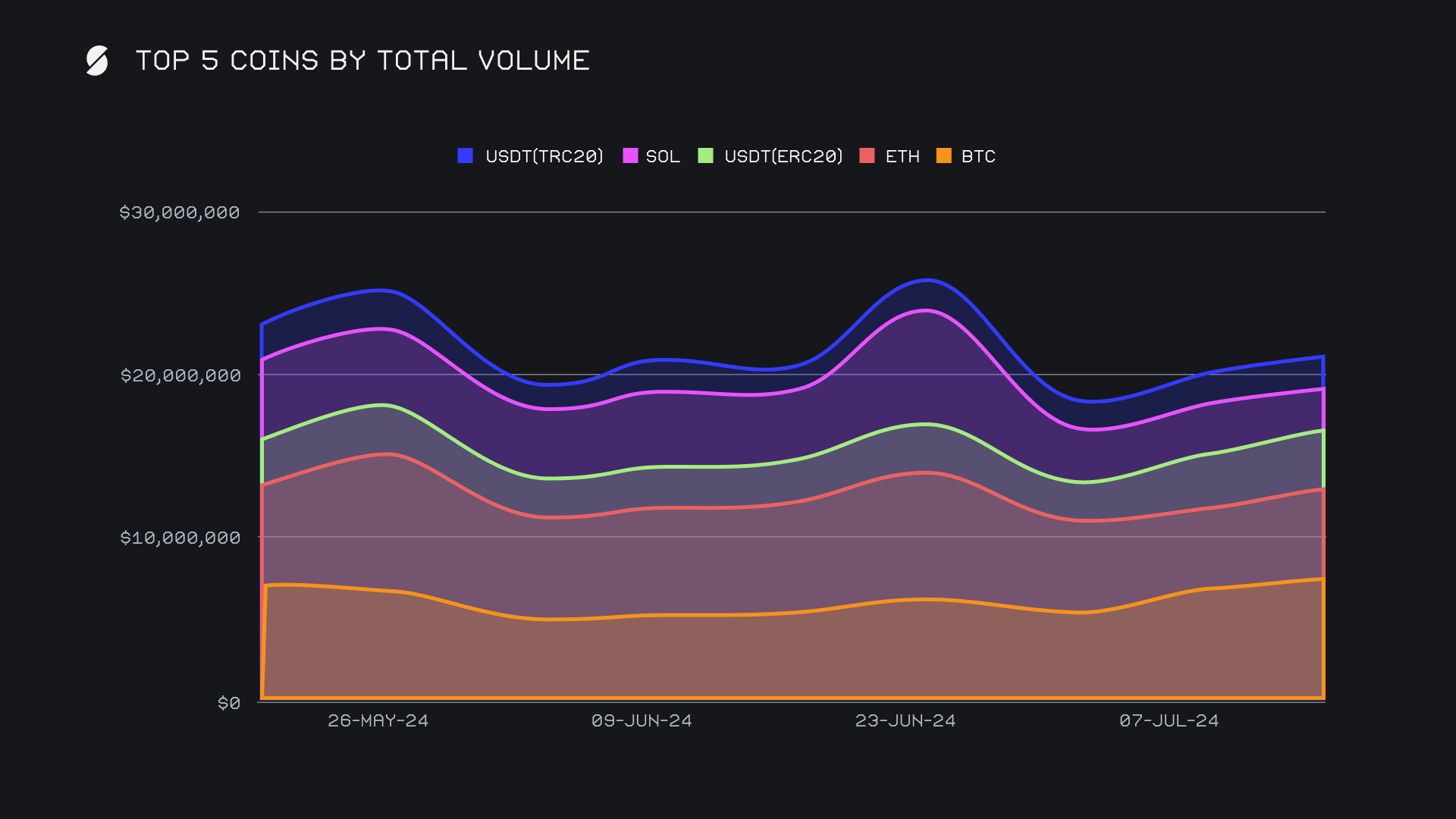

BTC retained its top spot this week with a total volume of $7.4m, reflecting a healthy increase of +12.0%, and representing the highest total volume achieved by BTC since late April, 2024. This growth was fueled by a substantial rise in deposit volume, which reached $3.6m (+45.3%), while the settle volume saw a decrease to $1.9m (-12.2%). This trend suggests that users were more inclined to deposit BTC rather than receive it, while instead preferring to settlements in other coins such as ETH.

ETH followed closely with a total volume of $5.7m, marking a solid gain of +12.2%. This was made up of notable increases in both deposit and settle volumes, with deposits climbing to $2.0m (+19.0%) and settlements rising to $2.4m (+15.8%). ETH continues to remain at the forefront of users' minds, as reflected by this week’s balanced growth, and also its ongoing strong performance. In comparison to SOL, it has remained consistently strong in recent months, and is usually always in contention for our most shifted coin in terms of volume.

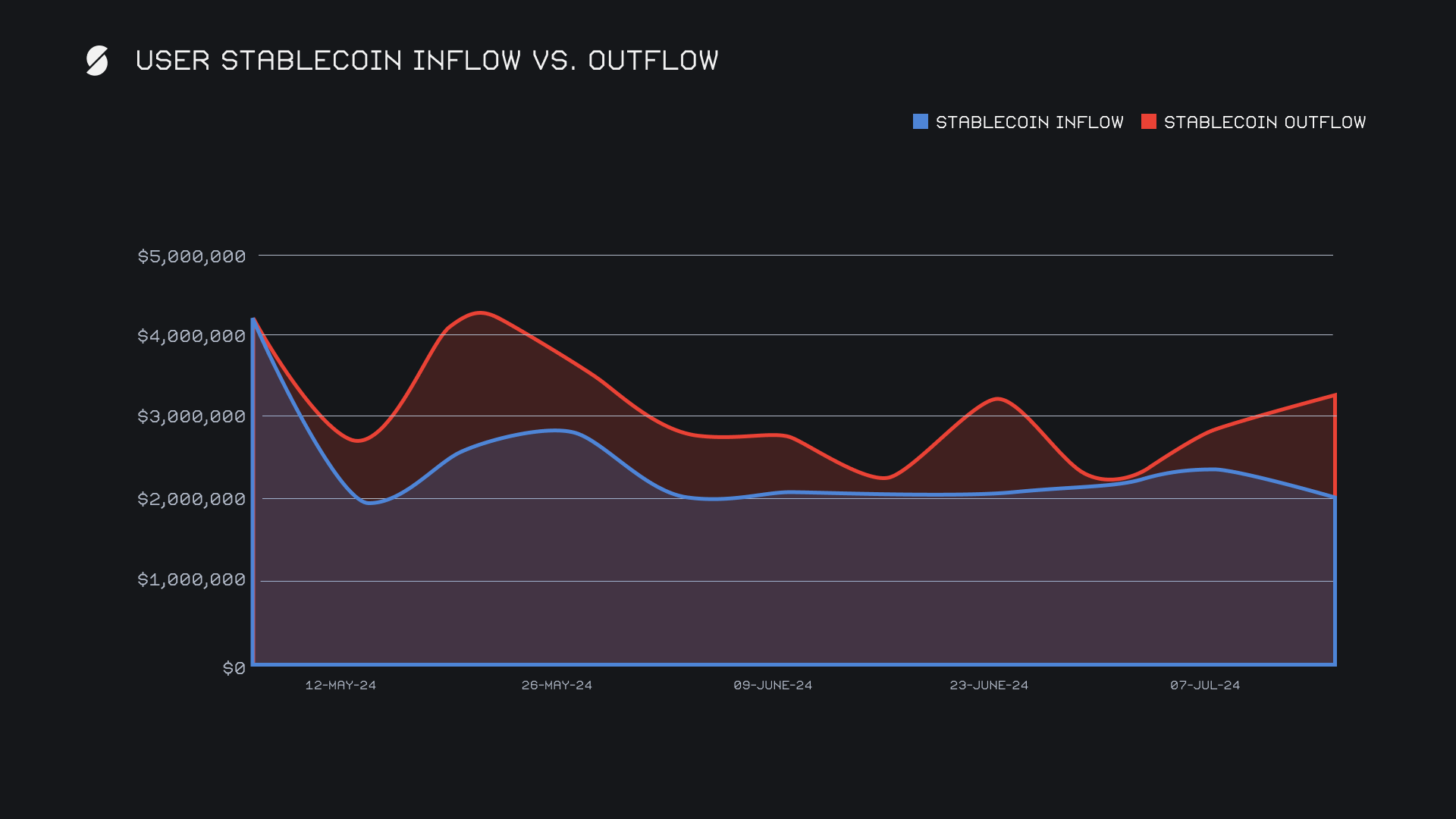

USDT (ERC-20) surpassed SOL for the first time in many months to claim third place, and ended with a total volume of $3.7m, up by +9.2%. Despite a drop in deposit volume to $760k (-16.9%), the settle volume saw a significant boost to $1.8m (+26.0%). This was the clear favorite among any stablecoin, although the trend of an increase in stablecoin settlements was evident this week. Our weekly stablecoin flow measured at -$1.1m, meaning that stablecoin settlements outweighed deposits by a total of $1.1m. USDT (TRC-20) and USDC (ERC-20) also contributed here, with both seeing their settlement sums jump more than +25% on the week. In the chart below you can see the recent divergence between stablecoin inflow vs. outflow.

SOL experienced a decline and dropped to fourth place with a total volume of $2.6m (-16.4%). Both its deposit and settle volumes fell, with deposits at $711k (-33.3%) and settlements at $1.2m (-16.8%). As previously mentioned, the attention shift away from SOL and to other top coins is quite notable at the moment. This week’s total volume for SOL finished nearly $5m less than its sum achieved just 3 weeks ago, which represented a local peak after multiple months of solid growth.

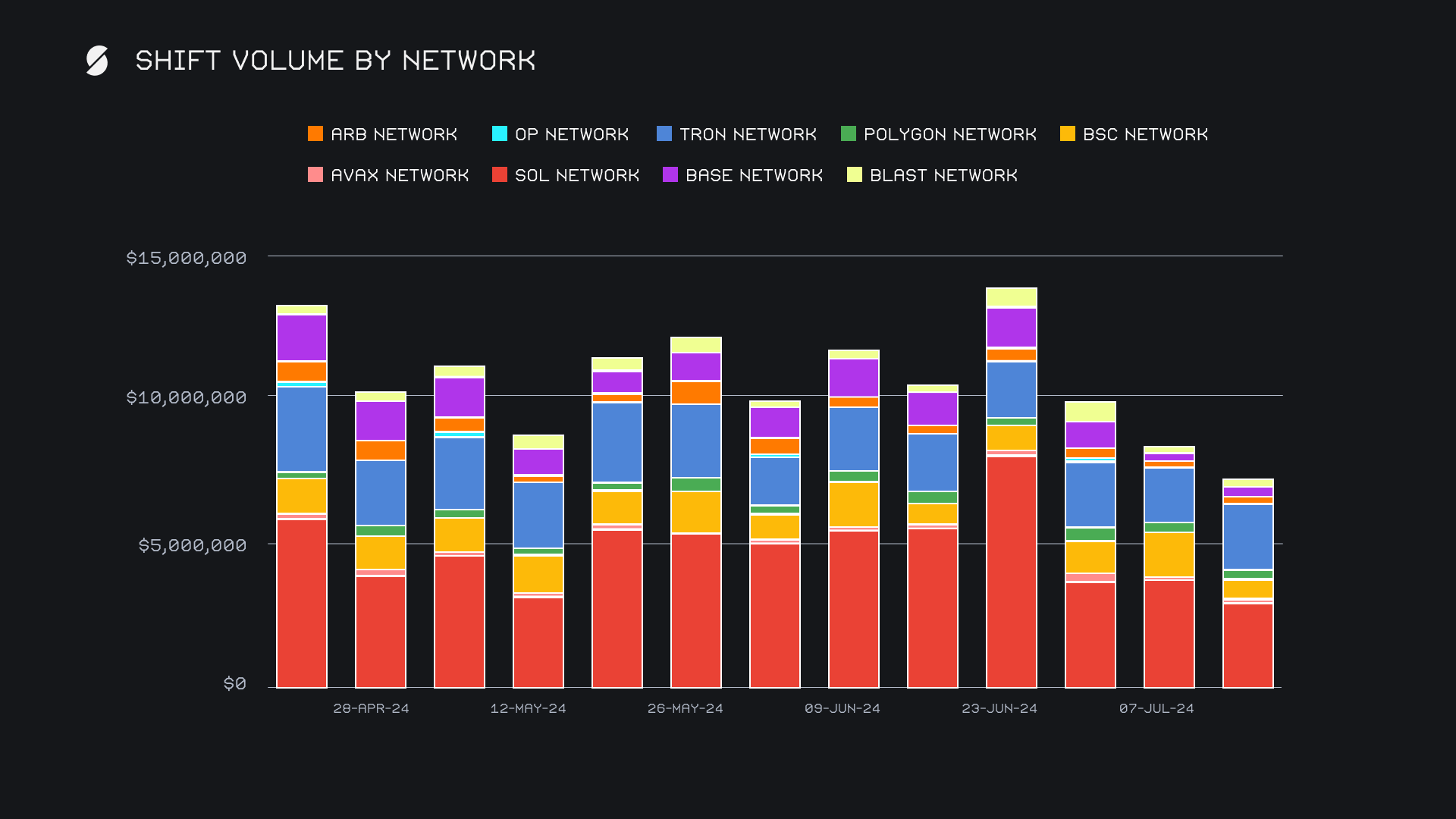

It was not only the native SOL token which was shown less attention, but also additional tokens on the Solana network. Stablecoins USDC (SOL) and USDC (SOL) saw their total volumes fall double digits for respective sums of $304k (-16.6%) and $142k (-42.1%). Additionally, popular altcoins on the Solana network such as WIF failed to generate any shift volume this week, although it is true that these coins tend to be more sporadic in shift nature. The end result for the Solana network as a whole was an -18% decline for a combined $3.0m, although it still remained the leader among alternate networks to ETH.

Following Solana, the TRON network saw a positive trend and climbed to $2.3m (+19.0%), bolstering TRON's position as a reliable network for shifting activities. The always consistent USDT (TRC-20) shifting was the primary driver behind this, as is typically the case for TRON. Aside from these two, all other alternate networks failed to see any truly significant shift action. The Binance Smart Chain (BSC) network ended in third with $677k, a whopping -57% decline following back to back weeks with sums greater than $1m. The Polygon and BASE networks came next and ended with respective totals of $362k (+28%) and $317k (+4%). It is clear that the current focus remains on top coins, and users are less concerned with alternate networks to ETH.

Affiliate News

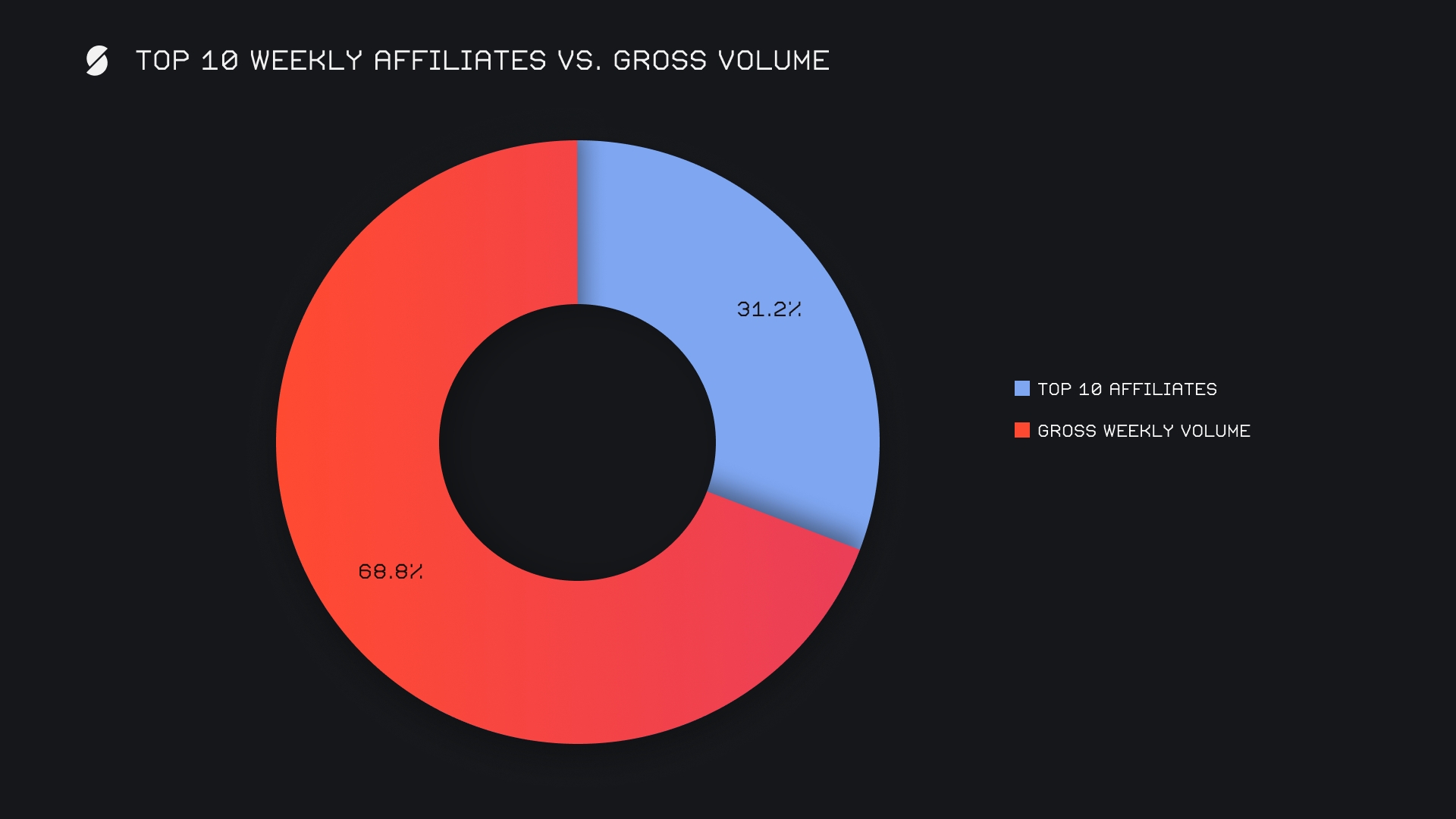

This week, our top affiliates generated a combined total volume of $4.34m, marking a solid increase of +14.6% from last week's $3.78m.

Our top affiliate made a significant leap, closing the week with a volume of $2.0m (+132.9%), showcasing impressive growth. Conversely, our second-place affiliate saw a decline, dropping 17.1% to $1.4m. The third-place affiliate also experienced a decrease, finishing at $644k (-30.9%). Despite these declines, the combined efforts of our top affiliates accounted for 31.2% of our total weekly volume, reflecting a solid contribution to our overall volume.

That’s all for now. Thanks for reading and happy shifting.