SideShift.ai Weekly Report | 9th - 15th May 2023

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the fifty-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the fifty-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

XAI Token Market Update

Throughout the week SideShift token (XAI) moved between the 7-day range of $0.1185 / $0.1241. At the time of writing, the price of XAI is sitting at the lower end of that range with a price of $0.1185, and has a current circulating supply market cap of $14,494,784 (-3.7%) as denoted on our Dune Dashboard.

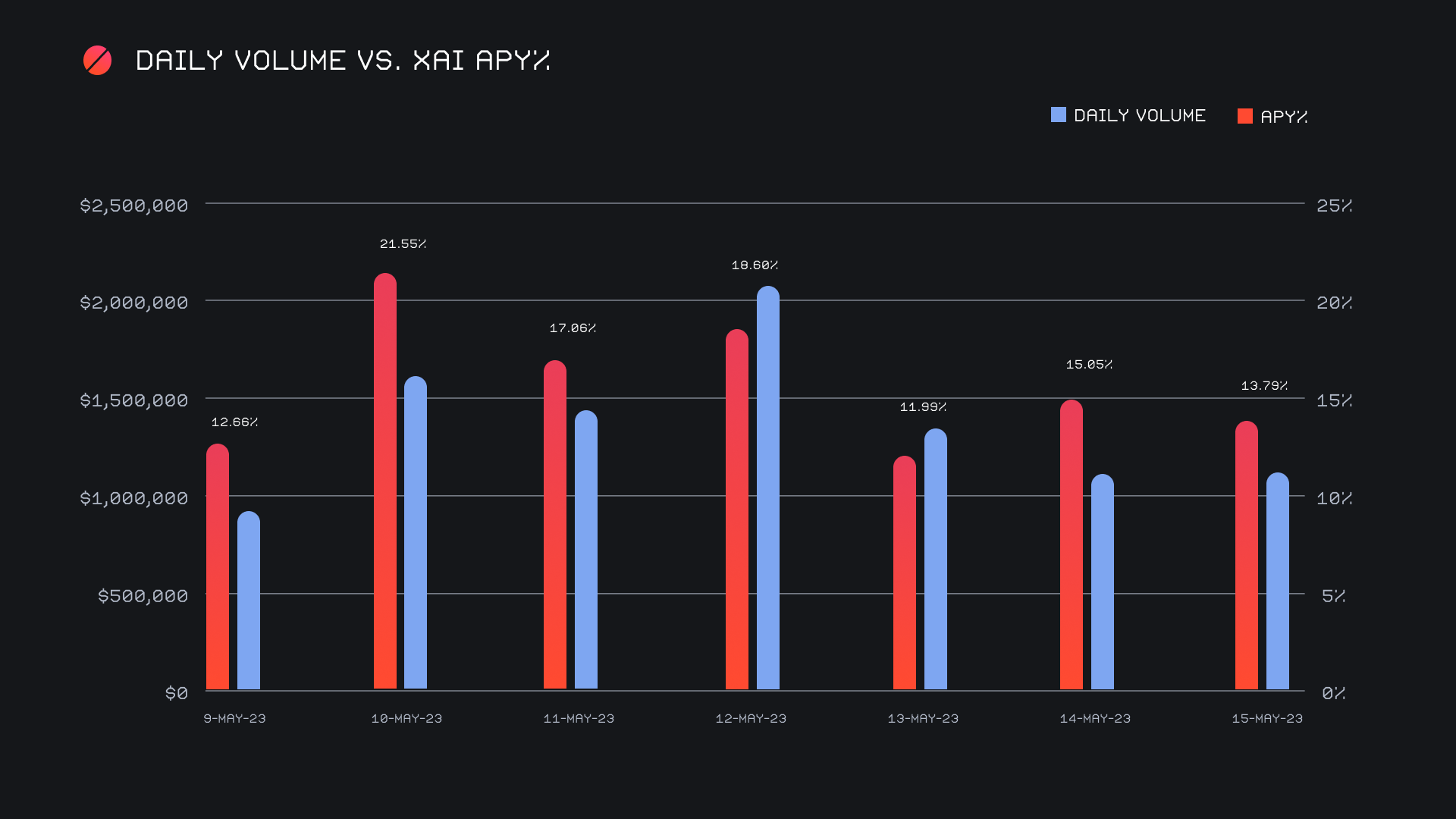

XAI stakers were rewarded with an average APY of 16.34% this week, with a daily rewards high of 52,360.23 XAI (an APY of 21.55%) being distributed to our staking vault on May 11, 2023. This was following a daily volume of $2.1m. As a whole, this week XAI stakers received a total of 275,255.83 XAI, or $31,982.18 USD in staking rewards.

In treasury news, an additional 50 ETH was added this week, bringing the current total to $4.39m. Users are encouraged to follow along with treasury updates directly via zapper.fi.

The price of 1 svXAI is now equal to 1.1893 XAI, representing an 18.93% accrual on stakers investments. A reminder that the easiest way to stake is to shift directly to svXAI from any coin of your choice.

Additional XAI updates:

Total Value Staked: 98,193,088 XAI (+0.3%)

Total Value Locked: $11,794,954 (-1.8%)

General Business News:

Following the burst of excitement that spurred from the recent memecoin craze, things have now largely cooled down with the vast majority of coins simply trotting along sideways.

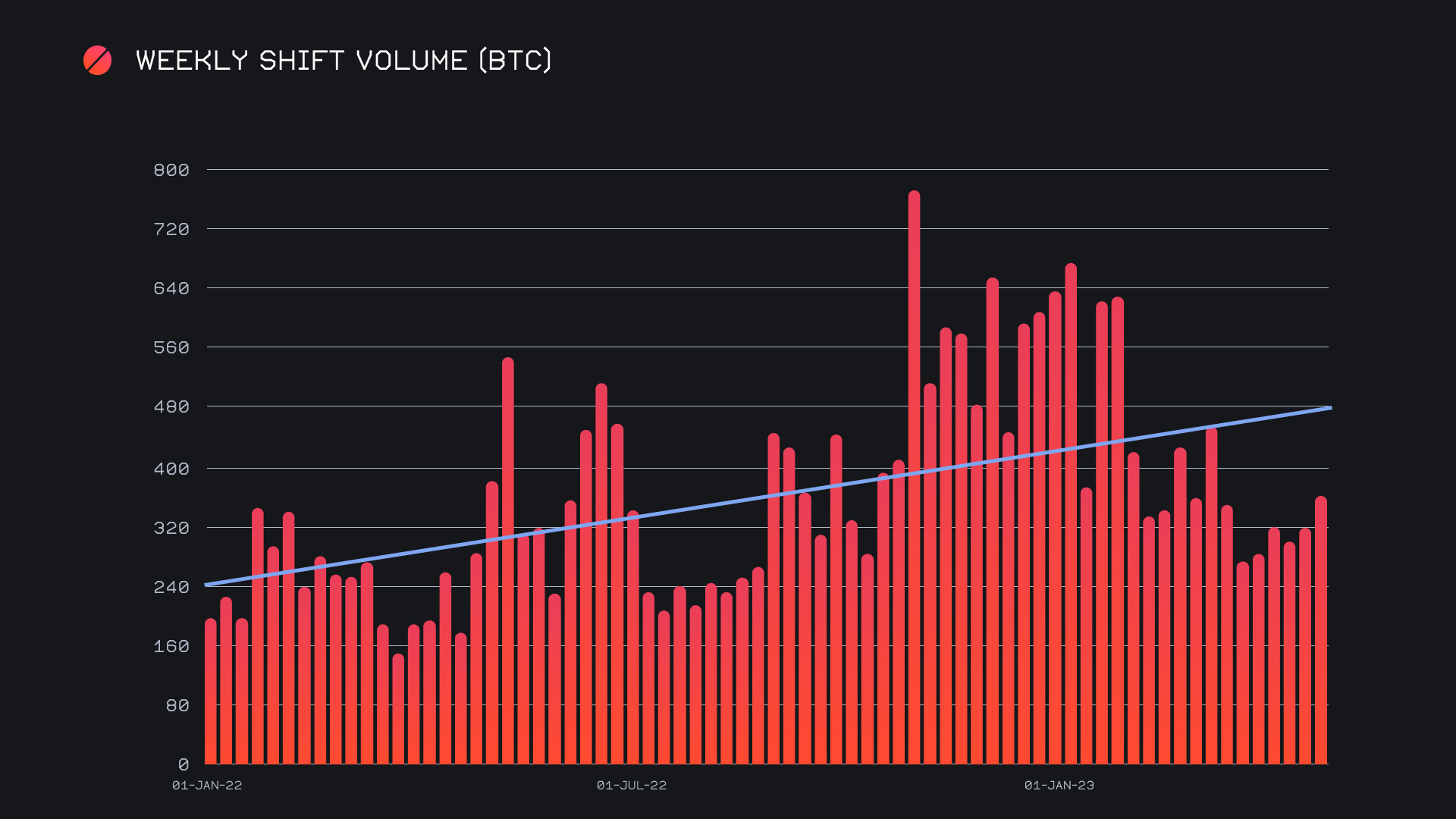

SideShift had a solid week, recording our highest volume in nearly 2 months. We ended the period with a gross volume of $9.7m (+7.6%) alongside a shift count of 6,939 (-0.8%). It is interesting to note that volume continues its gradual climb, despite the relative lull in shift count. Together, these figures combined to produce daily averages of $1.4m on 991 shifts. When denoted in BTC, our weekly volume increased 13.8%, for a total of 358.14 BTC.

The majority of shifts each week tend to revolve around BTC, and this week was no exception. Now for the 7th consecutive week, BTC has remained our most deposited coin with deposit volume incrementally increasing in the past three. A 9.1% increase resulted in a net user deposit volume of $2.0m, enough to secure the top spot. Conversely, second and third placed XMR and ETH saw respective declines of 9.5% ($1.3m) and 5.3% ($1.1m), which occurred in the wake of a week with heavy deposit volume. Despite the declines here, the continued concentration of deposit volume accounted for by our top 3 coins should not go unnoticed. Similar to last week, our third placed coin had nearly double the deposit volume of fourth place (USDT on Ethereum this week, with $570k), thereby speaking to the significance of these coins.

Another key contributor to the heavy BTC deposits was the return of the BTC / USDT (ERC-20) pair. It has been our most popular in 8 of the past 10 weeks, so it’s no surprise to see it re-emerge when the market is lackluster. The pair netted $1.1m and accounted for roughly 11.7% of our weekly volume. This was done so with just 137 shifts, or a mere 2% of our weekly count, which suggests the shift size here was quite large. 58% of the deposited BTC volume this week was shifted to USDT (ERC-20).

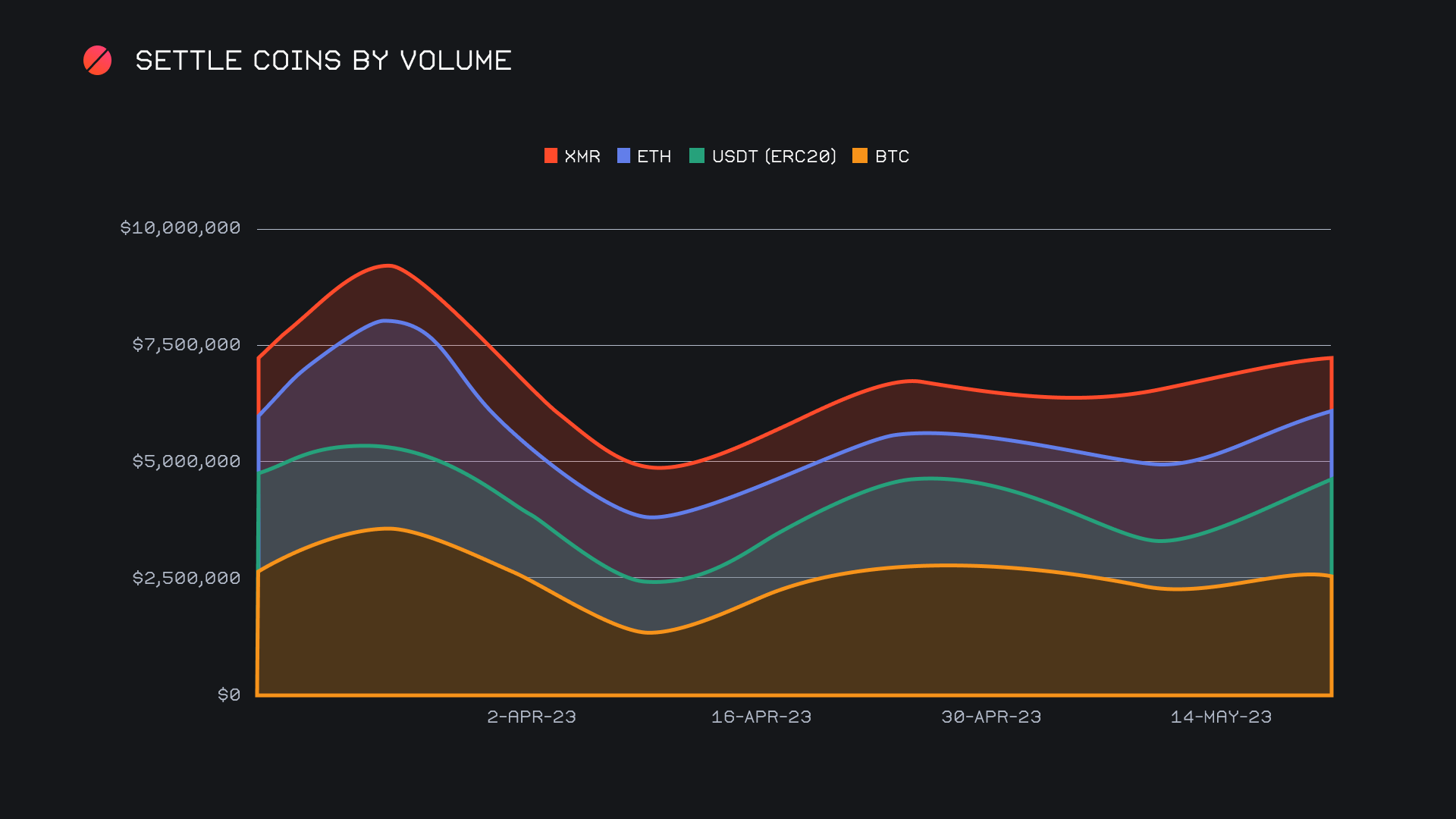

Directly related to this is perhaps the most interesting change of the week, a 90.4% spike in USDT (ERC-20) user settlements. This resulted in a settle volume of $1.61m, only just shy of BTC’s first placed $1.63m. Although going through ebbs and flows of their own, our top 4 settle coins have generally been trending up, after hitting what looks like a local low about one month ago.

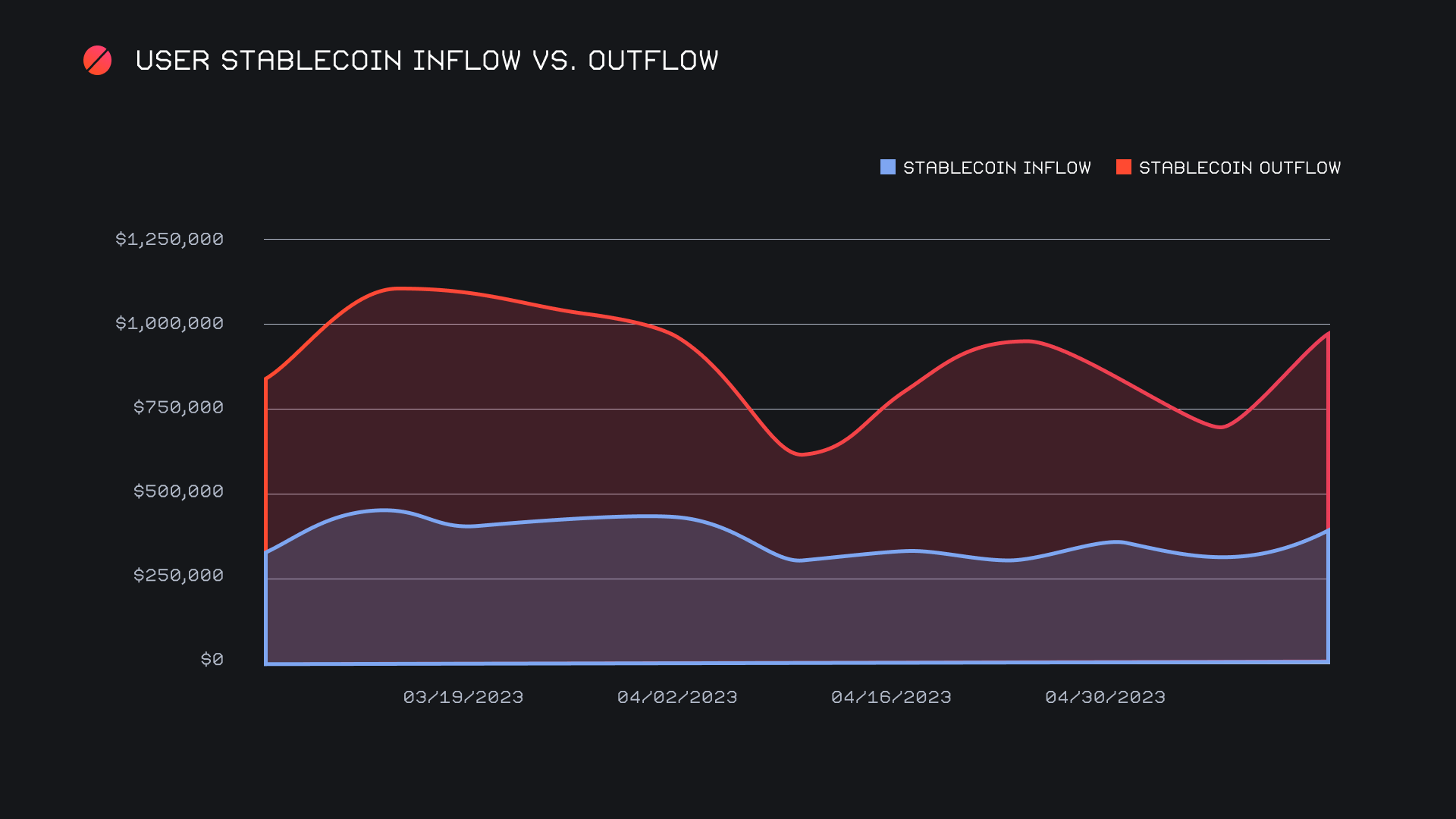

Although in particular USDT on Ethereum is storming its way to the top, stablecoins as a whole seemed to experience an increase in demand, with weekly stablecoin settlements rising 50% from last week for a combined $2.4m. As outlined in the chart below, while stablecoin inflow seems to remain quite steady, outflow fluctuates far more often. This week had a net flow of -$812k, meaning that our volume for stablecoin settlements exceeded user deposits by this amount. Since we began tracking this metric, outflow has trumped inflow. We will continue to monitor these changes, as stablecoin flows may serve as a solid gauge for general user sentiment.

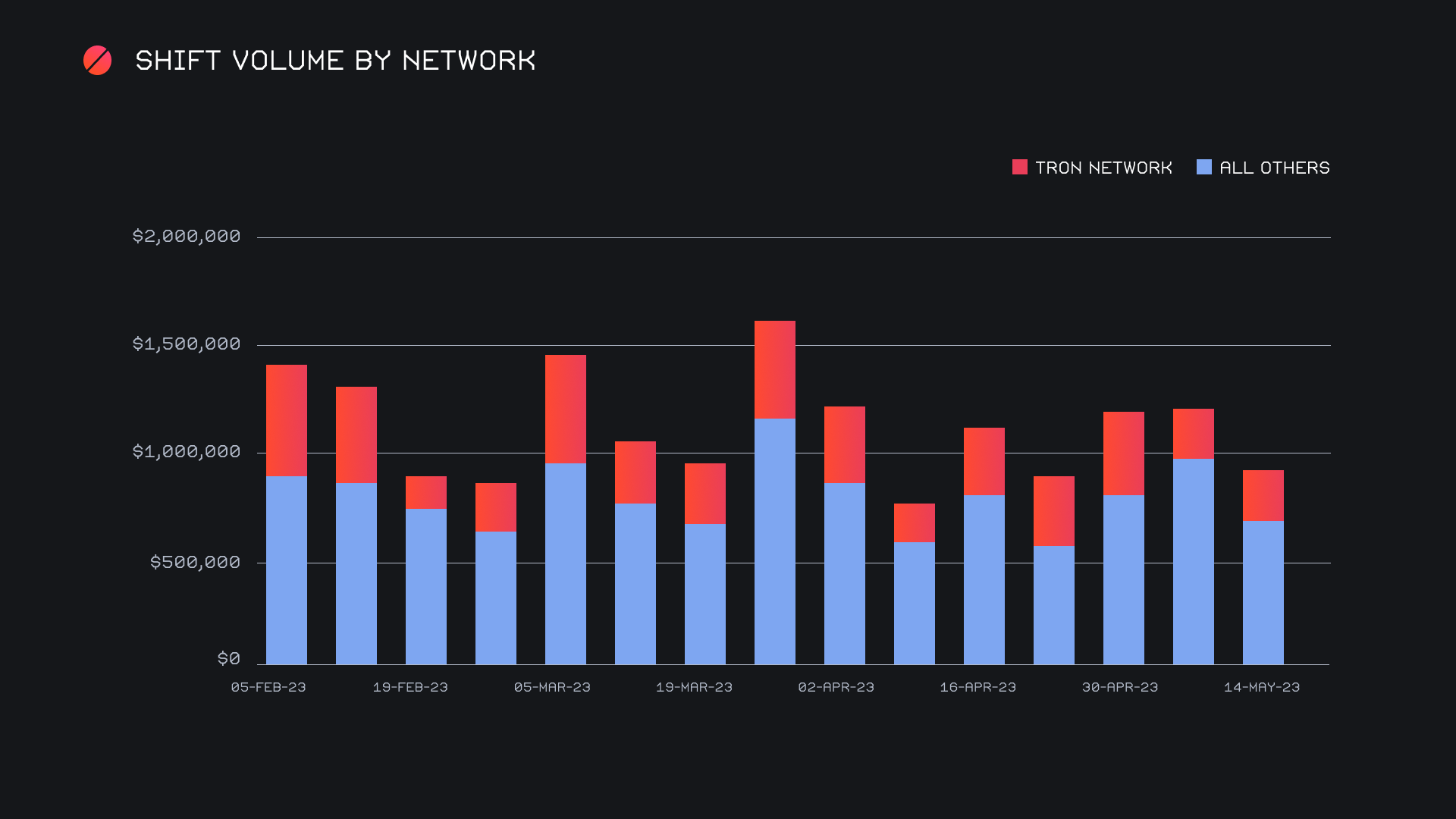

A quick look at alternate networks to Ethereum shows the Tron network climbing its way back to the top, as it grew by 7.6% for a net $471k. Although this isn’t the most impressive growth percentage, it in fact was the only network to see week on week growth (aside from AVAX, which rose a minor 0.5%). Second placed SOL dropped 14.5% for $468k, and following this, the changes continue to get more dramatic the further along we go. BSC declined by 24.8% for $433k, while action on ARB was cut in half, dropping 51.4% for $197k. This actually marks a two month low for Arbitrum, as it has continued to grow in popularity throughout that time. As a whole, these alternate networks failed to sustain the momentum which held them above the $2m mark, and finished the week with a combined $1.9m.

In listing news, SideShift added support for our newest stablecoin, USDT on Arbitrum. Shifting to USDT on Arbitrum is now live from any coin of your choice.

Affiliate News

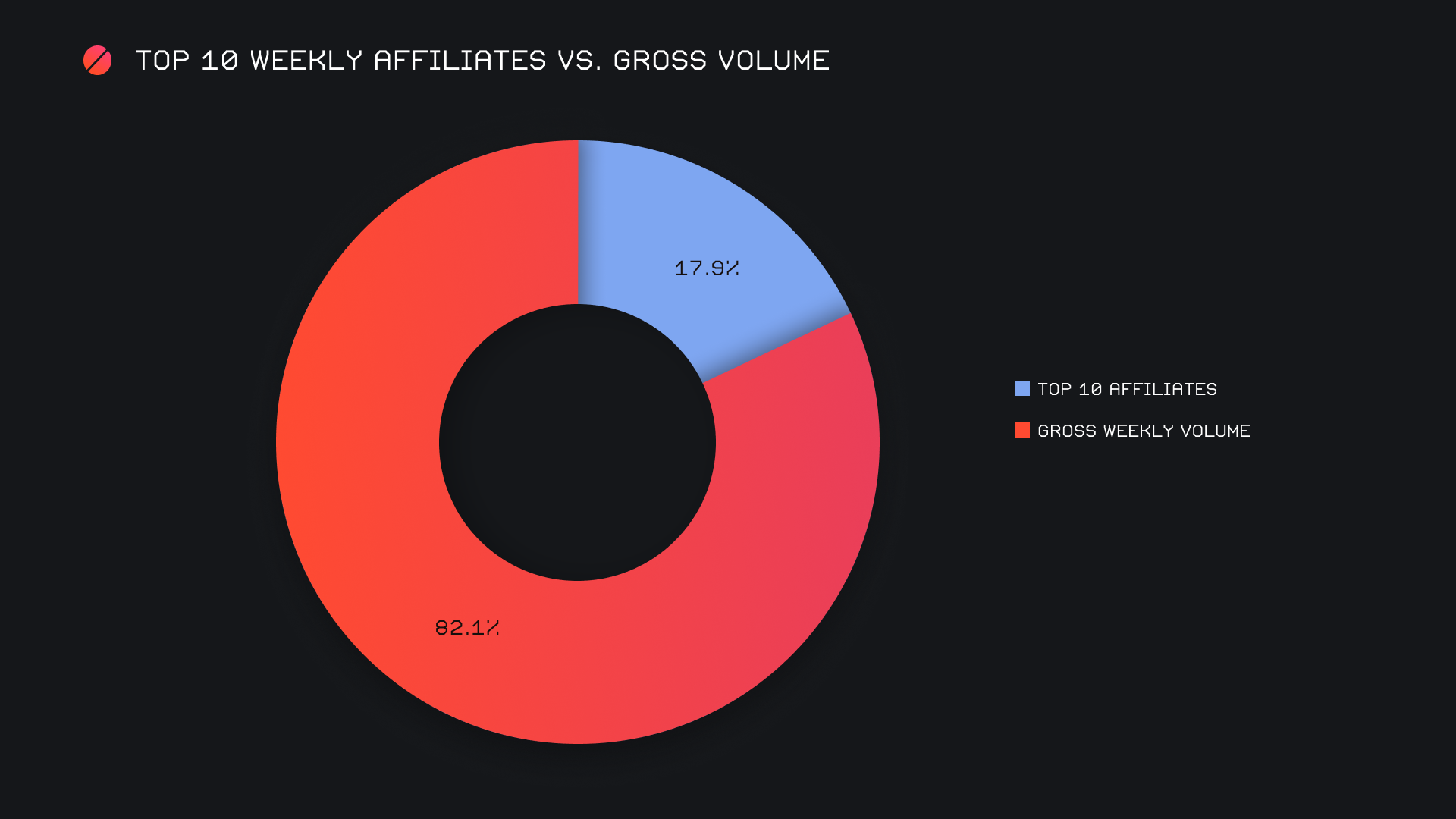

Our top 10 affiliates recorded an almost identical week to last, falling just 0.3% for ~$1.7m. Shift count however did see a decent rebound after a slow showing last week and increased 16.3% for a total 1,748 shifts. Our first placed affiliate also remained steady with little to no change from last week, as it accounted for 9% of total weekly volume and 9.7% of shift count.

All together, our top 10 affiliates represented 17.9% of our weekly volume, a 2.5% dip from last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.