SideShift.ai Weekly Report | 9th - 15th September 2025

SideShift Weekly Report: Most popular coins, XAI staking performance, and other interesting insights about SideShift.ai and the cryptocurrency space. Welcome to the one hundred and seventy-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Welcome to the one hundred and seventy-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

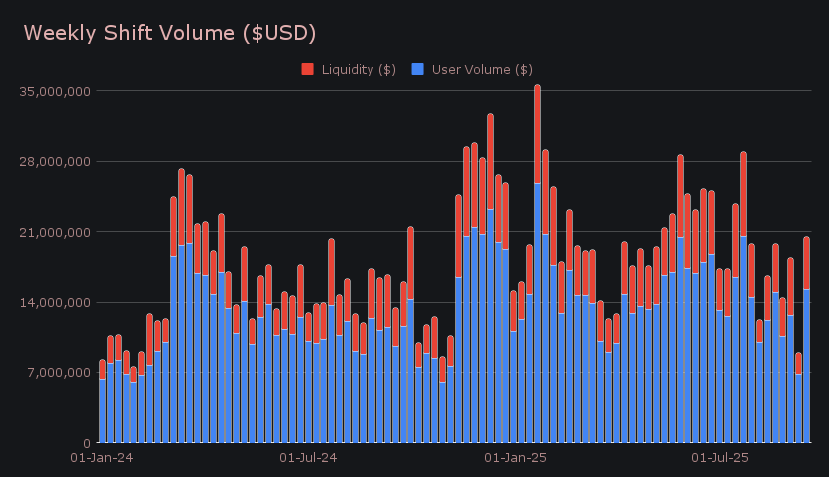

- SideShift rebounded strongly with gross volume climbing to $20.48m (+128.6%), a sharp recovery from last week’s slowest tally of the year.

- SOL reclaimed the crown at $7.03m in total volume (+431.7%), its first time leading all coins since February, driven by whale-size SOL/USDC (SOL) flows.

- BTC and ETH strengthened with $6.65m (+87.4%) and $3.66m (+103.2%) in weekly volume, as deposit-heavy BTC flows pointed to rotation into other majors.

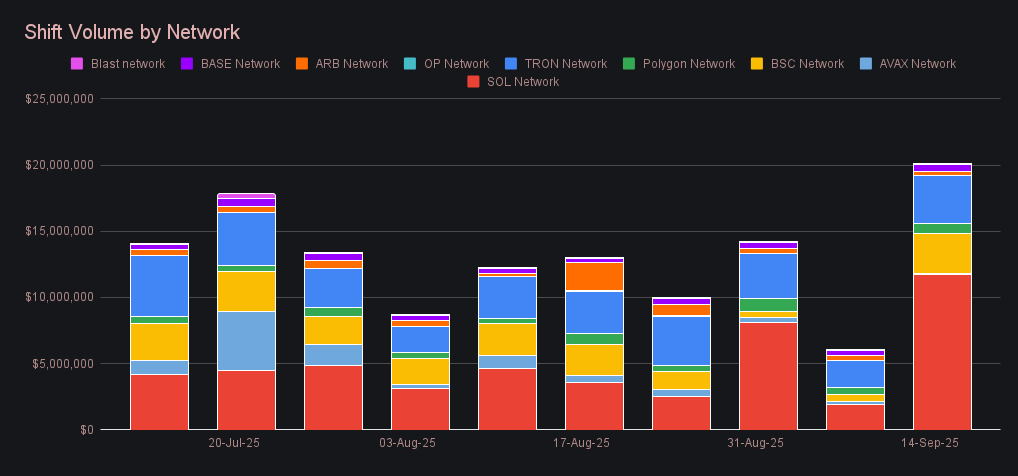

- Alt networks outpaced Ethereum with non-ETH chains totaling $20.1m (+233%), as Solana, Tron, and BSC together made up nearly 90% of alt flows.

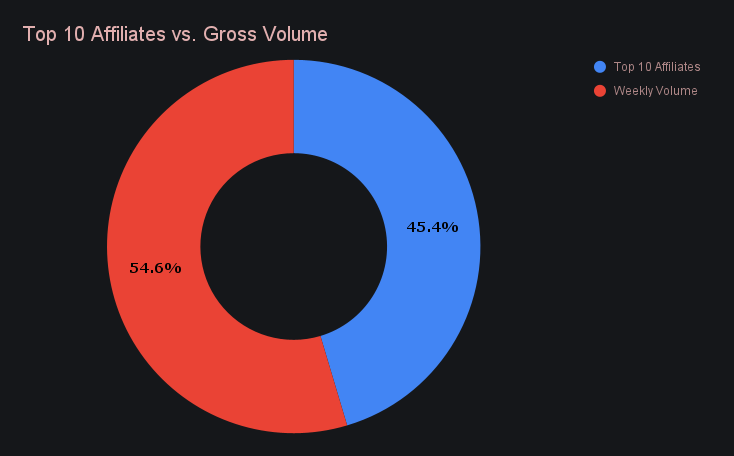

- Affiliates surged back to $9.30m (+302.4%), contributing 45.4% of total volume, with first place logging one of its strongest weekly finishes of 2025.

XAI Weekly Performance & Staking

XAI held a relatively steady course this week, moving within a compact band of $0.1631 to $0.1691. The token is currently priced at $0.1656, a small drop from last week’s close that leaves market cap at $25.45m, down −1.17% from $25.75m. The past 30-day chart shows a flattening trend after an early September climb, suggesting that XAI is consolidating following that brief push higher.

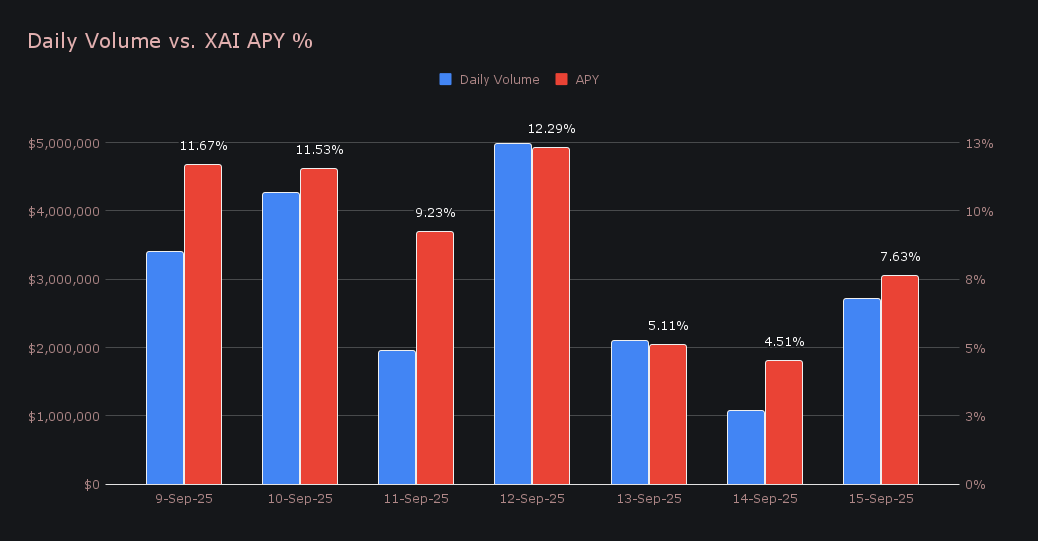

Staking results were stronger, with 224,421.27 XAI distributed across the week ($36,984.92) at an average yield of 8.85% APY. The standout performance came on September 12th, when 44,003.82 XAI was added to the staking vault at an APY of 12.29%, backed by $4.98m in daily SideShift volume. With activity across the site running higher, staking yields and rewards followed suit, lifting above the quieter levels logged in prior weeks.

SideShift’s treasury is sitting at a current estimated total of $31,306,000. Users are encouraged to follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 138,702,435 XAI (+0.1%)

Total Value Locked: $22,828,956 (−0.9%)

General Business News

Crypto markets stayed active this week, with BTC holding firm around $115k ahead of the upcoming FOMC meeting, where a rate cut decision could spark fresh volatility. Pump.fun’s token PUMP stole the spotlight among majors, leading all top coins with a +76.3% weekly gain as its market cap crossed $3 billion, fueled by its revenue-sharing model and revived livestreaming. SOL also impressed, nearly touching $250 over the weekend before easing back toward $235, with strong DAT buying underpinning its rally and leaving it up +22% over the past month.

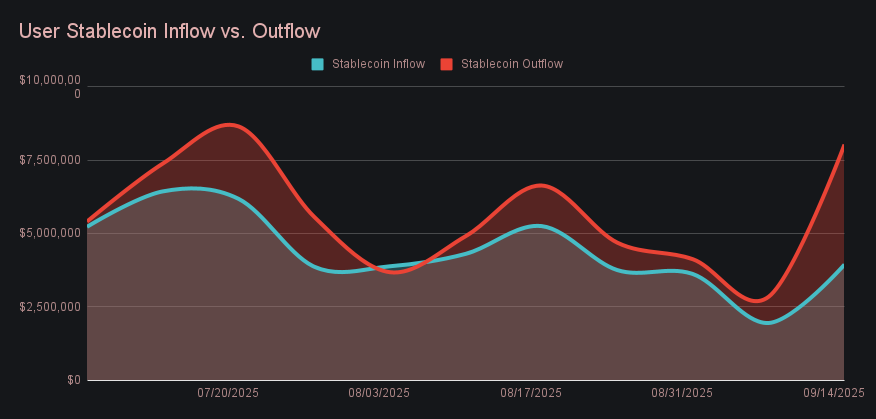

SideShift staged a sharp rebound, logging $20.48m in gross volume, a +128.6% surge that came directly after last week’s uncharacteristically slow performance. User activity accounted for $15.30m (+124.4%), while liquidity shifts climbed to $5.18m, reflecting heavier rebalancing needs alongside renewed market demand. The week’s standout pairs were led decisively by SOL/USDC (SOL) at $3.52m, followed by USDT (BSC)/BTC with $959k and BTC/ETH at $615k. The scale of SOL shifting was particularly important and underscored the extent to which flows rallied back compared to last week’s much smaller leaders.

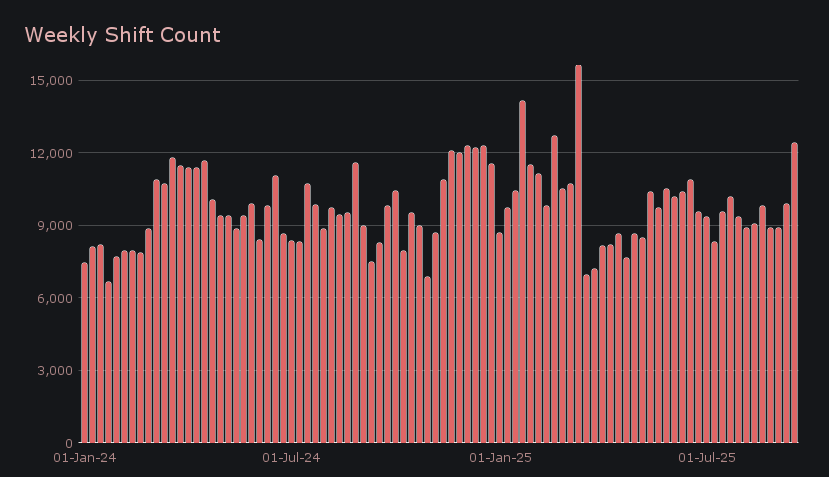

Gross shift count also rose sharply to 12,393 (+25.2%), or an average of 1,770 per day, though the composition of this increase was not directly tied to the volume rise. The spike was driven by a wave of smaller shifts completed through certain integrations, while the surge in overall volume came mainly from a handful of larger transactions executed elsewhere. It was not mid-sized flows that bridged the gap, but rather two ends of the spectrum — larger shifts lifting gross volume, and small-scale activity inflating gross count. This made for an unusual but decisive week of growth on both measures, and acted as a natural stress test of SideShift’s ability to process a high load across very different types of flows.

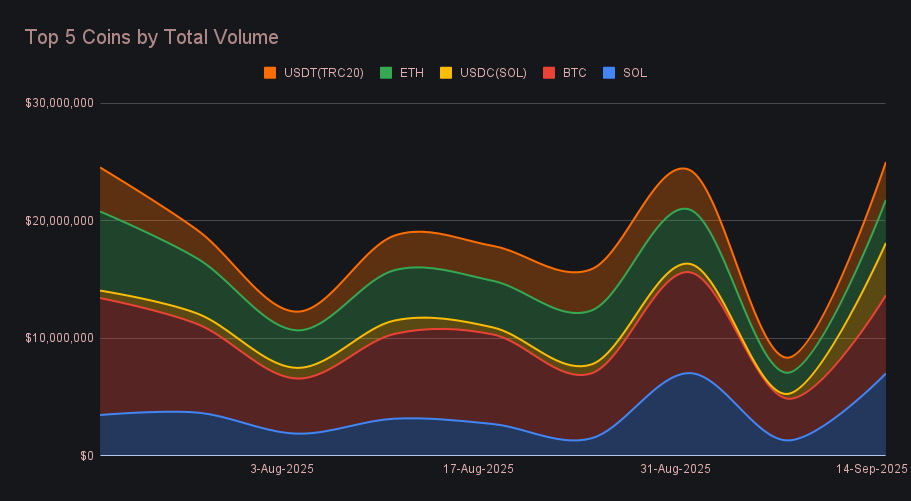

SOL reclaimed the top spot with a commanding $7.03m in total volume (+431.7%), the second time in the past three weeks it has cleared the $7m threshold, but the first time since early February that it has led all coins outright. Notably, our top five coins as a group averaged a robust +354% gain in total volume, making SOL’s performance stand out even more. SOL user deposits surged to $4.23m (+838%) while settlements reached $1.69m (+139.5%). Flows picked up on both sides but were ultimately dictated by the week’s leading pair — SOL/USDC (SOL) at $3.52m — where a whale user shifted heavily out of native SOL as its price climbed toward $250. This decisive flow set the tone and underscored SOL’s renewed pull as the dominant driver of SideShift activity this week.

BTC finished second with $6.65m in total volume (+87.4%), supported by broad flows across both user deposit volume ($2.92m, +98.2%) and settlements ($1.68m, +40.4%). The settlement rebound was driven primarily by the unusual USDT (BSC)/BTC pair, which logged a steady stream of $5k–$15k shifts, while deposits came from a wide mix of pairs in varying sizes. Taken together, the balance left volume leaning deposit-heavy, suggesting users were rotating out of BTC into other majors — notably ETH, SOL, and even LTC, which ranked as its top three settlement counterparts. ETH also strengthened, climbing to $3.66m in total volume (+103.2%). User deposits reached $1.66m (+55.5%), while settlements nearly doubled to $1.06m (+93.3%), signaling healthier two-sided engagement versus last week.

Stablecoins rounded out the top five, led by a breakout from USDC (SOL) at $4.45m in total volume (+996.6%). The bulk came from settlements at $3.66m, making it the single largest gain of any top-20 coin this week and underscoring how quickly capital rotated within the Solana ecosystem. USDT (TRC-20) also advanced to $3.23m (+152.4%), with both deposits and settlements rising in tandem, a reminder of its role as one of the most consistently used stablecoins on SideShift. By contrast, USDT (ERC-20) has looked lackluster this past month and this week grew only modestly (+5.4% for $1.92m), finishing as the 8th most active coin overall and the 4th most used stablecoin, a surprising development given its steady presence throughout 2025.

Alternate networks to ETH climbed to $20.1m (+233%) in total volume (deposits + settlements), outpacing the Ethereum network’s own $6.89m (+22%) and marking one of the sharpest rebounds of the year. The Solana network dominated with $11.73m (+510.6%), thanks in large part to the heavy popularity of same-chain shifting, which inflated activity far above its usual share. Tron followed at $3.58m (+72.7%) and BSC reached $3.02m (+493.2%), together accounting for nearly 90% of all alternate network flows. Polygon and Base also improved, climbing to $757k (+48.4%) and $581k (+63.5%), respectively, while Arbitrum and Avalanche contracted to $303k (−20.3%) and $132k (−51.6%). Collectively, the outsized growth of these networks pushed alt networks firmly back ahead of Ethereum flows this week.

The SideShift buildathon is in full swing with 94 builders participating at the time of writing. Continuing for 3 months total, interested developers can join at any time and earn a share of the $10,000 USDC prize pool.

Affiliate News

Affiliate flows exploded to $9.30m (+302.4%), a stark reversal from last week’s lull and a clear sign of how central integrations were to SideShift’s recovery. The leaderboard reshuffled once again, with a new entrant climbing into third at $388k (+52.1%). Second place also impressed, rising to $1.88m (+293.7%), while first place retained its crown with a commanding $5.92m (+880.8%), one of the stronger weekly finishes by any affiliate this year, and the highest total for this particular partner since late July. While volume was led decisively by the top two, fourth place proved influential in its own right by driving shift count, generating an impressive 3,663 shifts. Collectively, our top affiliates contributed 45.4% of total site volume, a jump of nearly +20% from last week.

That’s all for now - thanks for reading and happy shifting.